Indonesia remains a key destination for foreign direct investment (FDI), with inflows reaching USD 22.12 billion in Q1 2024, signifying a 4.9% year-on-year growth according to the Investment Ministry/BKPM. However, various economic and operational factors may necessitate a foreign-owned company to cease operations in Indonesia. This guide provides an overview of the company dissolution process and explores alternatives to shutting down completely. Indonesia’s economic landscape continues to entice foreign investors, attracting a substantial USD 22.12 billion in foreign direct investment (FDI) during the first quarter (Q1) of 2024. This represents an impressive 4.9% increase compared to the corresponding period in the previous year, affirming Indonesia’s appeal as an investment destination. However, despite the country’s allure, certain economic and operational factors may prompt foreign-owned companies to contemplate the difficult decision of ceasing operations in Indonesia.

One of the alternatives discussed in the guide is business suspension. Business suspension allows companies to temporarily cease operations while retaining their legal status and assets. This option may be beneficial for companies experiencing financial difficulties or those seeking to restructure their operations. The guide outlines the process of applying for business suspension, the conditions that must be met, and the implications of this alternative.

Understanding Foreign Direct Investment in Indonesia

FDI refers to an investment made by a company or individual in one country into business interests located in another country. In Indonesia, this often takes the form of establishing subsidiaries, acquiring shares in existing companies, or forming joint ventures with local partners. FDI plays a crucial role in Indonesia’s economic development, contributing to job creation, technology transfer, and overall economic growth.

Reasons for Closing a Foreign Investment in Indonesia

The decision to dissolve a foreign-owned company in Indonesia can be complex and multi-faceted. Common reasons include:

- Unprofitable Operations: Sustained financial losses may prompt a company to cease operations to avoid further financial strain.

- Shift in Global Strategy: Changes in a company’s overall global strategy or market focus may lead to the decision to exit specific markets.

- Regulatory Challenges: Indonesia’s regulatory environment can be complex and subject to change. Difficulties navigating these regulations or compliance issues can be a contributing factor.

- Operational Challenges: Operational issues such as difficulties finding skilled labor, supply chain disruptions, or cultural differences can impact a company’s performance and lead to closure.

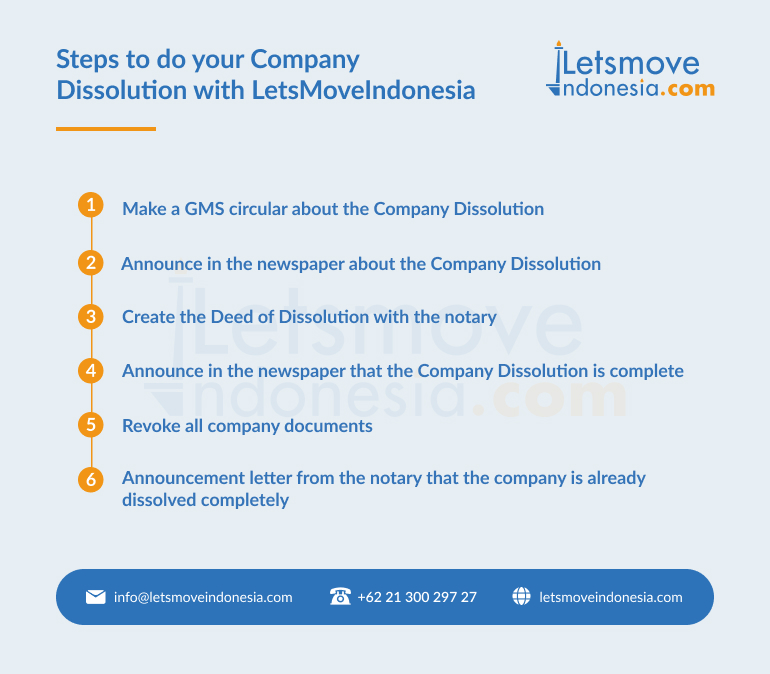

The Dissolution Process

The process of dissolving a foreign-owned company in Indonesia involves several steps:

- Shareholders’ Resolution: The shareholders must pass a resolution to dissolve the company at a General Meeting of Shareholders (GMS).

- Appointment of Liquidator: A liquidator, who may be a professional or an individual, is appointed to oversee the dissolution process.

- Announcement and Notification: The dissolution is announced in the newspaper and the State Gazette of the Republic of Indonesia. Creditors are notified and given a timeframe to submit claims.

- Asset Liquidation: The liquidator collects and sells company assets to settle outstanding debts.

- Distribution of Remaining Assets: Any remaining assets are distributed among shareholders.

- Legal Entity Termination: The Ministry of Law and Human Rights (MOLHR) issues a decree terminating the company’s legal status.

Alternatives to Dissolution: Acquisition

Before opting for complete dissolution, foreign investors should consider alternative strategies, such as acquisition. Selling the company to another investor can offer several advantages:

- Recover Investment: An acquisition allows for partial or full recovery of the initial investment, mitigating financial losses.

- Maintain Market Presence: The acquiring company may choose to continue operations, allowing the brand and market presence to be maintained.

- Avoid Dissolution Complexities: Acquisition bypasses the lengthy and often complex dissolution process.

Key Considerations for Acquisition

If considering an acquisition, it’s crucial to:

- Identify Potential Buyers: This could include local or international companies interested in the specific industry or market.

- Prepare Financial Statements: Ensure financial statements are up-to-date and accurately reflect the company’s value.

- Seek Professional Guidance: Engage legal and financial advisors to navigate the complexities of the acquisition process.

The decision to dissolve a foreign-owned company in Indonesia should not be taken lightly. While the process can be intricate, understanding the steps involved and exploring alternatives like acquisition can help ensure a smooth and potentially profitable exit strategy.

Lets Move Indonesia offers comprehensive support to foreign investors throughout their business journey in Indonesia, from establishment to dissolution or acquisition. Our expert team can provide guidance on the dissolution process, assist with identifying potential buyers, and facilitate the acquisition process, ensuring your interests are protected and maximizing the value of your investment.

Found this article interesting? Check out our other useful articles about visas here!

The Indonesia Visa on Arrival – Everything you need to know now!

Bali Visas – Guide to Bali Visa for UK Citizens

The Indonesia Visa on Arrival 2023 – Everything you need to know now!

LetsMoveIndonesia – 2022 Bali Visas Recap

Jakarta Visas – How to Get a Jakarta Visa on Arrival

Electronic Visa on Arrival (e-VOA) is Now Available For 27 Nationalities