- Home

- Tax Services

- Individual Tax Reporting

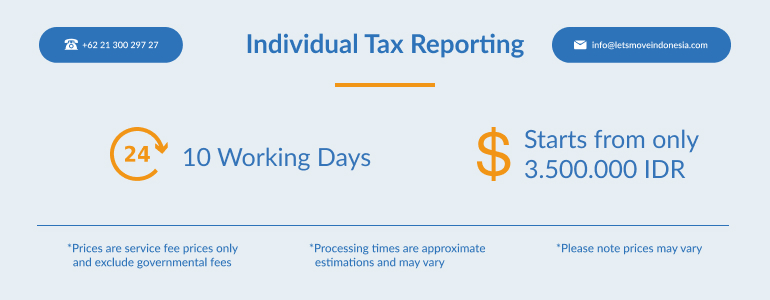

Individual Tax Reporting

Tax & Accountancy Services

- Share:

Individual Tax Report is for employees who work in the private sector or state-owned companies, as well as employees working for the government.

The individual subjected to pay the Individual Tax must first register to the Directorate General of Tax in order to acquire the Tax ID (NPWP).

The registration will require series of documents to be submitted bearing in mind that you will need to be wary of the frequent changes of the tax regulations in Indonesia.

It is compulsory for the individuals to file the tax report to the Indonesian Tax Authority, which is required by the applicable Indonesian Law.

Common Questions

What is the tax rate for the Individual Tax?

The rate would be as follows:

Taxable Income Tax Rate

First Rp.50.000.000 5%

Between Rp.50.000.000 to Rp.250.000.000 15%

Between RP. 250.000.000 to Rp.500.000.000 25%

Over Rp.500.000.000 30%

When is the deadline to process the Individual Tax to the Tax Authority?

The deadline for it to be processed would be on the 31st March of every year.

What is the consequence if you didn’t make an Individual Tax ID?

You are inclined to be charged with an extra 20% of your tax report. You could also deal with the enforcement authority which could subject to sentences according to the applicable law.

What if you’re leaving Indonesia? What would happen to the obligation of reporting the Individual Tax?

If you’re only leaving Indonesia temporarily, you are still obligated to file the Individual Tax Report. However, if you’re leaving Indonesia permanently, you need to notify the Indonesian Tax Authority regarding your departure and your cancellation of your Tax ID (NPWP).

Why do you need a legal advisor to register your Export License?

We can help you to determined which HS Code is needed so that you can get your Export License without any problems.

Fully inclusive Tax Packages

To make your life simpler, LetsMoveIndonesia offers fully serviced packages to ensure your business operates smoothly. The All Inclusive Package takes care of your Monthly and Annual Reporting and saves you lots time, stress and money! To find out more Click Here!

Want to know more about taxes in Indonesia? Then check out our useful guide!

Tax in Indonesia – Your Most Common Questions Answered!

If you need to know more or would like us to help with your tax reporting, then contact the LetsMoveIndonesia team.

Our experienced team has years of tax experience and can help with your monthly & yearly tax reporting, individual tax reporting, as well as your payroll and accountancy needs.

Make your life easier and let Jakarta’s Most Trusted Agency assist you.

T: 021 300 297 27 E: [email protected] Visit us in our office Bellagio Mall, Jl. Mega Kuningan Barat Kav.E4 No.3, Setiabudi, Jakarta 12930, Indonesia or fill in the contact form below!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

As demand for inbound investment and relocation to Indonesia accelerates, Lets Move Indonesia proudly announced the extension of its exclusive 10% discount on all new immigration consulting services. Originally set to expire at the end of April, the campaign will now run through August 31, 2025, aligning with the region’s peak relocation and business setup […]

Lets Move Indonesia

06/19/2025

While this growing influx of expatriates and international visitors contributes positively to economic and cultural development, it also presents increasing risks of immigration violations, ranging from overstays and misuse of residence permits to failures in reporting presence and providing required information to immigration authorities. To address these concerns, the Directorate General of Immigration Indonesia has […]

Lets Move Indonesia

05/20/2025

This year, we are offering a variety of tantalising sales on our legal and visa products to help you save money and get the service you deserve! Check out the Lets Move Indonesia Visa & Legal Sale. At Lets Move Indonesia, we have been helping individuals and international businesses since 2016 live, travel and make […]

Lets Move Indonesia

05/06/2025

Since 2016 Lets Move Indonesia has been at the forefront of expatriate services revolutionising our industry by introducing transparent pricing, which has set prices across the country and therefore made Indonesia a safer place to do business and to expand. Whether you are an international company or looking to get your dreams off the ground, […]

Lets Move Indonesia

04/16/2025

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025