- Home

- Legal Services

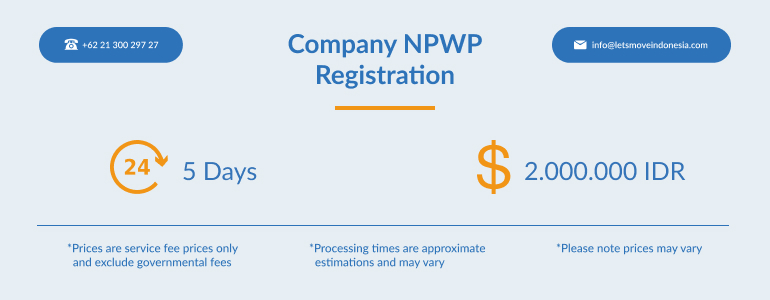

- Company NPWP Registration

Company NPWP Registration

Company Registration & Legal Services

- Share:

Company NPWP Registration – Who is it for and what are the benefits

The Tax Identification Number (NPWP) is a set of numbers given to taxpayers (both individual and business entity) for personal identification in carrying out their taxation rights and obligations. NPWP is given to eligible taxpayers who fulfil the subjective and objective requirements, as stipulated in taxation laws and regulations.

In order to carry out all taxation activities, a business must first have an NPWP. The business NPWP is different from the NPWP you have for your personal needs.

If you want to run a business in Indonesia, you must first obtain a company NPWP to make sure you are following the right tax requirements. LetsMoveIndonesia assists and makes sure your company is registered and eligible to conduct all tax matters for your business.

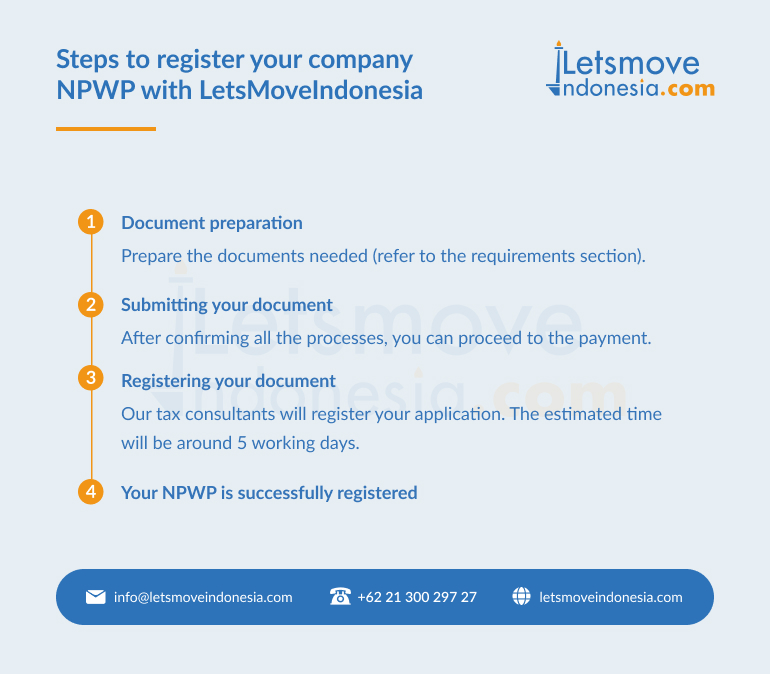

Steps to register your company NPWP with LetsMoveIndonesia

Prepare the documents needed (refer to the requirements section).

After confirming all the processes, you can proceed to the payment.

Our tax consultants will register your application. The estimated time will be around 5 working days.

Common questions

Can I use my individual NPWP for my business?

An individual NPWP can only be used to report individual taxes. Business entities need a separate tax number so that it can be used to complete tax affairs according to applicable regulations.

What tax regulation stipulates corporate tax in Indonesia?

The regulation that stipulates corporate tax in Indonesia is Law No. 36 of 2008. which is explained that Income Tax (PPh) is a tax imposed on individuals and entities based on

the amount of income received for one year. These provisions regarding PPh were first regulated in Law no. 7 of 1983

How much should I pay for the Annual Corporate Income Tax?

For the Annual Corporate Income Tax, the rate of CIT is 22% generally applies to net taxable income.

Is there any difference between making NPWP for PT and PMA?

No, there is no difference between making NPWP PT and PMA.

Requirements

- For Indonesian Individuals, scan a copy of the KTP

- For Foreign Individuals, scan a copy of a valid passport, scan copy of KITAS (staying permit),

- Domicile Letter from Management Building or RT/RW (Subdistrict),

- For the Company, scan a Copy of the Deed of Establishment (AKTA) and SK Menkumham. Identity of shareholders.

- Identity of Boards of Directors.

- Information of email and phone number

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

As demand for inbound investment and relocation to Indonesia accelerates, Lets Move Indonesia proudly announced the extension of its exclusive 10% discount on all new immigration consulting services. Originally set to expire at the end of April, the campaign will now run through August 31, 2025, aligning with the region’s peak relocation and business setup […]

Lets Move Indonesia

06/19/2025

While this growing influx of expatriates and international visitors contributes positively to economic and cultural development, it also presents increasing risks of immigration violations, ranging from overstays and misuse of residence permits to failures in reporting presence and providing required information to immigration authorities. To address these concerns, the Directorate General of Immigration Indonesia has […]

Lets Move Indonesia

05/20/2025

This year, we are offering a variety of tantalising sales on our legal and visa products to help you save money and get the service you deserve! Check out the Lets Move Indonesia Visa & Legal Sale. At Lets Move Indonesia, we have been helping individuals and international businesses since 2016 live, travel and make […]

Lets Move Indonesia

05/06/2025

Since 2016 Lets Move Indonesia has been at the forefront of expatriate services revolutionising our industry by introducing transparent pricing, which has set prices across the country and therefore made Indonesia a safer place to do business and to expand. Whether you are an international company or looking to get your dreams off the ground, […]

Lets Move Indonesia

04/16/2025

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025