- Home

- Tax Services

- Annual Tax Reporting

Annual Tax Reporting Indonesia

Tax & Accountancy Services

- Share:

Annual Tax, specifically in Indonesia, is tax that needs to be paid every year to the tax authority in Indonesia, which is the Directorate General of Tax.

The subjects that are inclined to file the tax report to the tax authority in Indonesia are both individuals as well as corporates that must acquire Tax ID (NPWP) or receive income through profits such as wages, dividends, revenues, and other source of income.

In order to process the Annual Tax Report to the tax authority in Indonesia, first you need to register yourself as an individual, or the company that is subjected to comply with the Annual Tax to the Directorate General of Tax.

The registration will require a series of documents to be submitted, bearing in mind the frequent and sudden changes to tax regulations in Indonesia.

Please note that it is compulsory for the individuals and corporates to file the tax report to the Indonesian Tax Authority, which is required by the applicable Indonesian Law.

Annual Tax Return Reporting in Indonesia

The annual tax return in Indonesia, known as SPT (Surat Pemberitahuan Tahunan), is a critical document for both individual and corporate taxpayers. This report outlines the taxpayer’s annual income, tax calculations, and tax obligations for the year. In Indonesia, all taxpayers are required to file their annual tax return with the Directorate General of Taxes (DJP).

Understanding tax regulations is essential for compliance and to avoid potential penalties. Taxpayers need to calculate their tax liability based on their annual income and ensure that all necessary information is included in the tax return. Failure to submit the annual tax return on time can result in fines and interest on unpaid taxes.

In summary, the annual tax return is a vital aspect of tax reporting in Indonesia, ensuring that taxpayers fulfill their tax obligations while providing the government with necessary revenue for public services.

Common Questions

When is the deadline to process the Annual Tax to the Indonesia Tax Authority?

The deadline for the Individual Annual Tax would be on the 31st March every year. For the Corporate Annual Tax, it will be on 30th April every year.

Can you submit your tax report past the deadline?

- Yes, you can apply for an extension of deadline for the tax report by notifying the Directorate General of Tax beforehand.

- What happens when you’re late on submitting your report past the deadline and are there any exceptions to not file an Annual Tax Report?

- You will be charged 2% monthly interest on the payable tax, and also charged with an administrative fee of Rp.100.000 for individual tax, and Rp.1.000.000 for corporate tax.

- An individual that will only be staying for less than 183 days in Indonesia, within the taxable year, is not obligated to file the Annual Tax Report.

What if you’re leaving Indonesia? What would happen to the obligation of reporting the Annual Tax?

If you’re only leaving Indonesia temporarily, you are still obligated to file the Annual Tax Report. However, if you’re leaving Indonesia permanently, you need to notify the Indonesian Tax Authority regarding your departure and your cancellation of your Tax ID (NPWP).

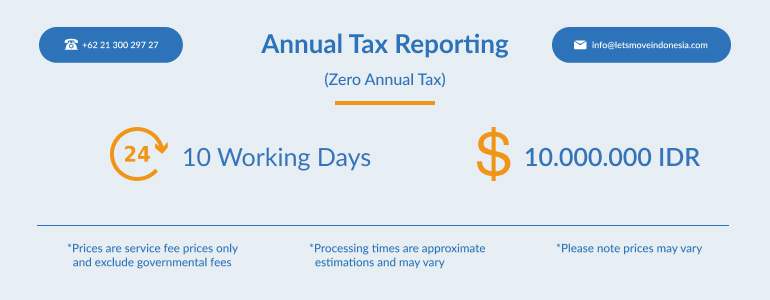

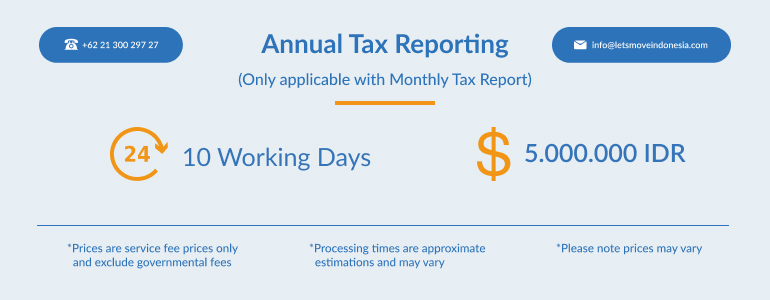

Fully inclusive Tax Packages

Lets Move Indonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business operates smoothly at a cost-effective price. To find out more about our packages, Click Here!

Want to know more about taxes in Indonesia? Then check out our useful guide!

Tax in Indonesia – Your Most Common Questions Answered!

If you need to know more or would like us to help with your tax reporting, then contact the Lets Move Indonesia team.

Our experienced team has years of tax experience and can help with your monthly & yearly tax reporting, individual tax reporting, as well as your payroll and accountancy needs.

Make your life easier and let Jakarta’s Most Trusted Agency assist you.

T: 021 300 297 27 E: [email protected] Visit us in our office Bellagio Mall, Jl. Mega Kuningan Barat Kav.E4 No.3, Setiabudi, Jakarta 12930, Indonesia or fill in the contact form below!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

As demand for inbound investment and relocation to Indonesia accelerates, Lets Move Indonesia proudly announced the extension of its exclusive 10% discount on all new immigration consulting services. Originally set to expire at the end of April, the campaign will now run through August 31, 2025, aligning with the region’s peak relocation and business setup […]

Lets Move Indonesia

06/19/2025

While this growing influx of expatriates and international visitors contributes positively to economic and cultural development, it also presents increasing risks of immigration violations, ranging from overstays and misuse of residence permits to failures in reporting presence and providing required information to immigration authorities. To address these concerns, the Directorate General of Immigration Indonesia has […]

Lets Move Indonesia

05/20/2025

This year, we are offering a variety of tantalising sales on our legal and visa products to help you save money and get the service you deserve! Check out the Lets Move Indonesia Visa & Legal Sale. At Lets Move Indonesia, we have been helping individuals and international businesses since 2016 live, travel and make […]

Lets Move Indonesia

05/06/2025

Since 2016 Lets Move Indonesia has been at the forefront of expatriate services revolutionising our industry by introducing transparent pricing, which has set prices across the country and therefore made Indonesia a safer place to do business and to expand. Whether you are an international company or looking to get your dreams off the ground, […]

Lets Move Indonesia

04/16/2025

Bali has become a top choice for foreigners to invest in real estate. But research on the property market can be tricky if you are unaware of the local laws and regulations. The good news is that buy a property in Bali is actually a possibility for foreign investors, yet there are regulations and rules on […]

Lets Move Indonesia

03/25/2025

Indonesia property market in 2025 is presenting a golden chance to investors. Rapidly growing economy, urbanization, and favorable government policies, now it is the right time to enter into this market. Let’s discover more about it. Current Trends in the Indonesia Property Market The Indonesian economic growth train on track with an annual increase rate […]

Lets Move Indonesia

03/25/2025