- Home

- Tax Services

- WLK Registration

WLK Registration in Indonesia

Tax & Accountancy Services

- Share:

WLK Registration – Who is it for and what are the benefits

WLKP stands for Wajib Lapor Ketenagakerjaan Perusahaan, which is one of the employment services on the kemnaker.go.id portal related to company information. Registering your company through WLKP is compulsory in order to update your company data in the Ministry of Manpower database.

By signing up through WLKP, your company will automatically be registered in the Ministry of Manpower database which will be used by the government to provide better services related to employment in the general public or institutions.

Failure to report WLKP in Indonesia will lead to sanctions and fines.

Common Questions

Who should report a WLK in Indonesia?

The company/ employer should make a written report regarding their manpower/ employment (According to the Law of the Republic Indonesia No. 7-1981)

What are the sanctions for failing to report WLK?

According to Article 10 of Law No. 7 – 1981 regarding mandatory labour reporting. In the law, companies that do not report their labour will be subject to a fine of up to Rp.1,000,000 or imprisonment of up to 3 months.

Can I hire a TKA (foreign employee) without submitting WLK report?

No, The Company is not allowed to hire TKA if they do not submit a mandatory manpower report/WLK.

Can we do WLK report online?

Yes absolutely, WLK report can be done online by visiting and click the official website of www.wajiblapor.kemnaker.go.id

Should I register my company again through WLK when I had registered it directly through the Ministry of Manpower?

Yes, Company registration through WLKP is intended to update your company’s data in the Ministry of Manpower database as well as provide access to your company to use other employment services that have been integrated with the Ministry of Manpower’s service portal.

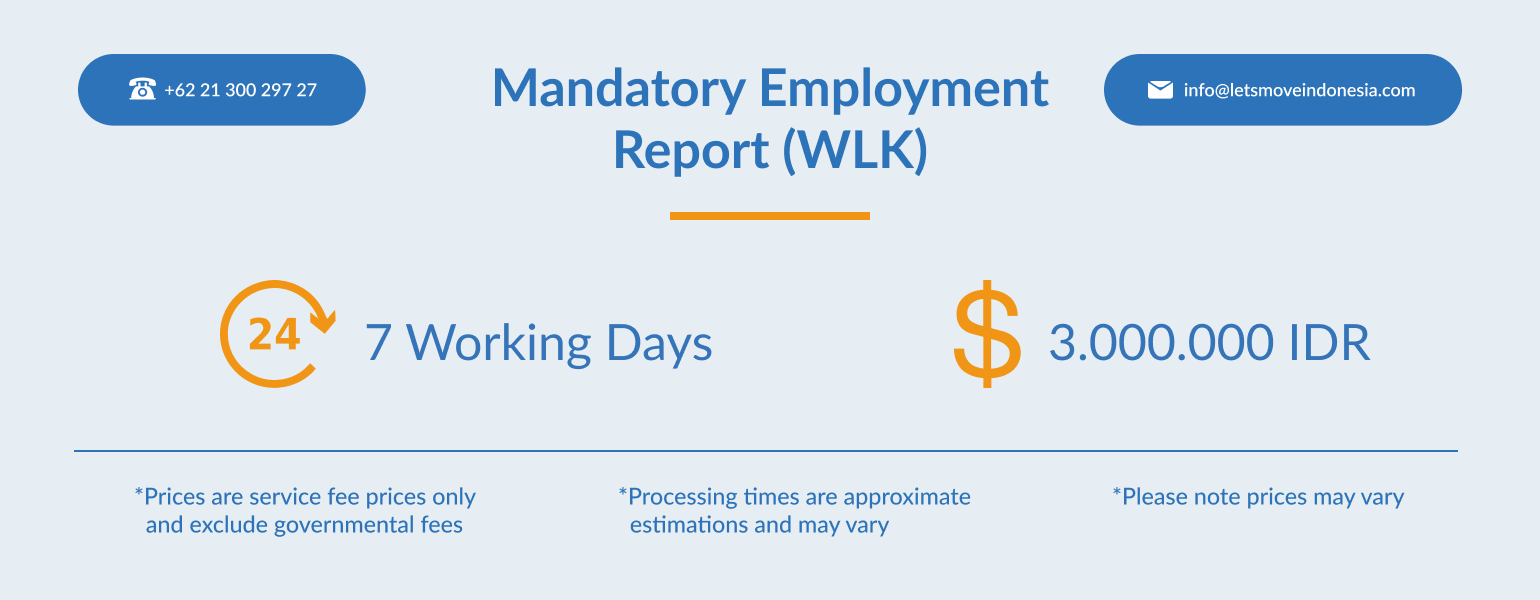

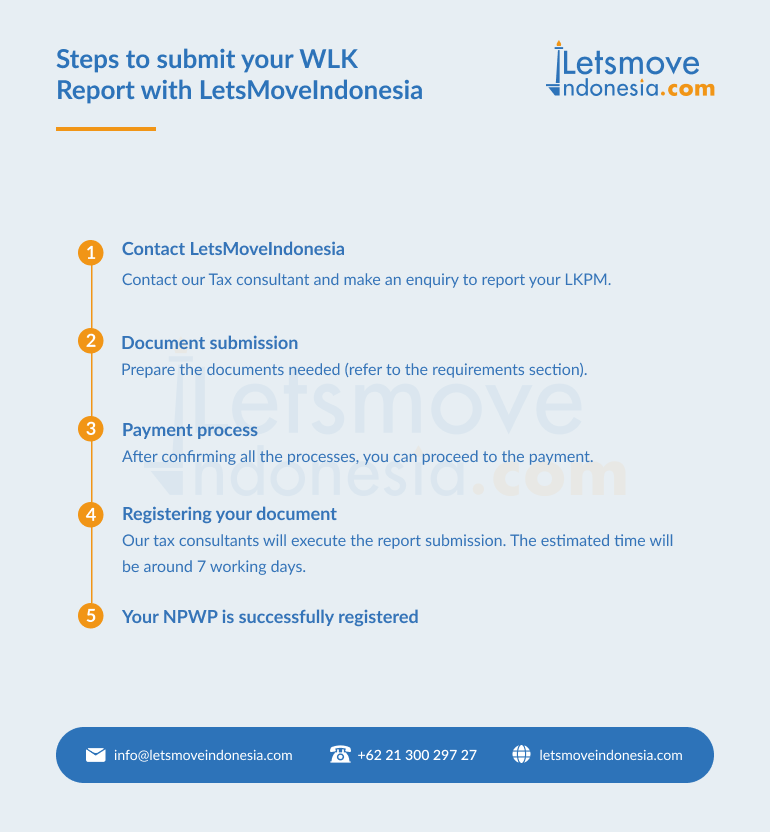

Steps to submit your WLK Report with Lets Move Indonesia

- Please Contact our Consultant and make an enquiry to include the report your WLK

- Prepare all the documents needed (refer to the requirements section)

- After confirming all the processes, you may proceed with the payment.

- Our consultant will execute the report submission. The estimated time frame will be around 7 working days.

Requirements

Before your WLK report is accepted and ratified, there are requirements related to employee welfare programmes that must be completed as an indicator for companies in implementing employee welfare programmes, such as:

- Identity cards of company’s employees. Should your company have a foreign employee, you must submit 10 local employee identities per 1 foreign employee identity submission.

- Social Security Services (BPJS Ketenagakerjaan) of the company.

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Natalia Harfiana

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Natalia Harfiana

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025