- Home

- Tax Services

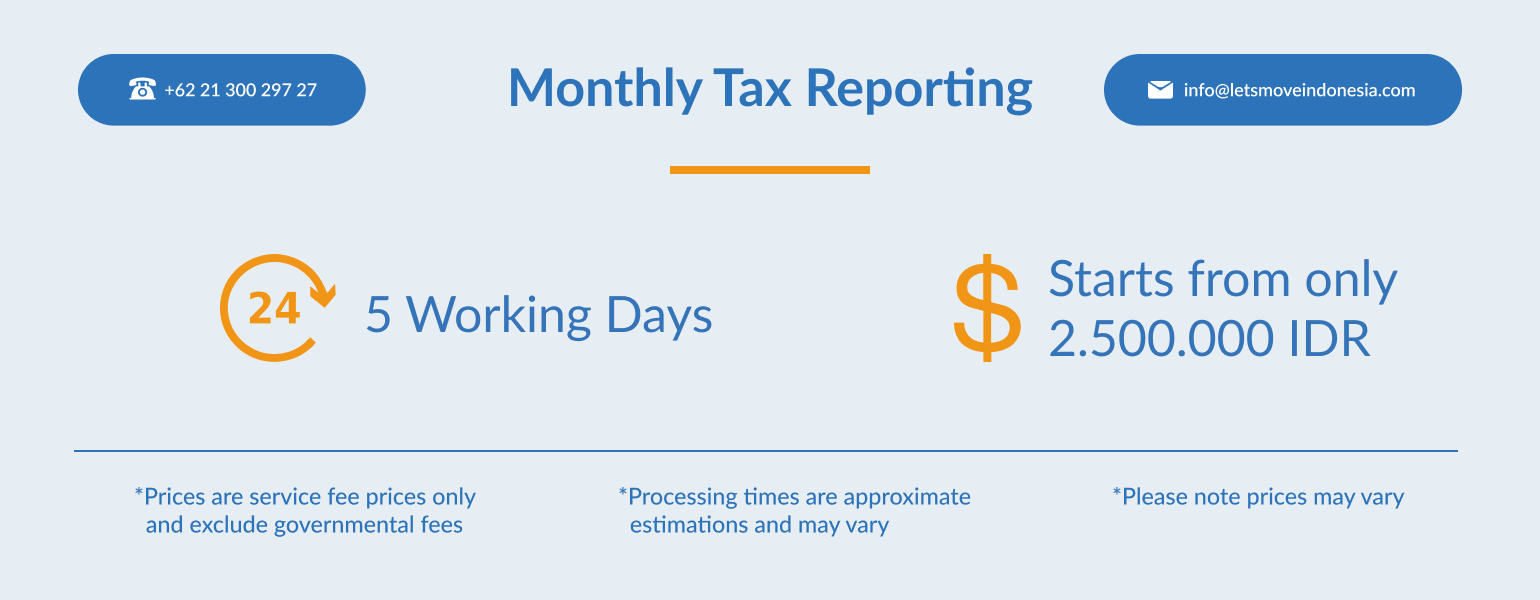

- Monthly Tax Reporting

Monthly Tax Reporting

Tax & Accountancy Services

- Share:

Tax matters in Indonesia can be quite complicated, time consuming and frustrating due to the vast amount of laws, regulations and grey areas that govern it; however, if you are a long term resident, a business owner or working within Indonesia, you will need to understand your Indonesian tax obligations.

One surprising factor new business owners encounter when they open a business in Indonesia is that, not only do they need to do annual tax reporting, but also monthly reporting. This can be extremely costly and should be a consideration for all new business owners when you register your business.

When Should You Start Your Monthly Tax Reporting?

Once you have established a business in Indonesia you have to register as a taxpayer. You will get a tax ID number / tax registration number (NPWP), tax relief certificate (SKT), and taxable VAT entity confirmation number (SPPKP) – which is additional, if your business has a gross revenue more than 4.8 billion IDR in a year.

Once you have a NPWP and SKT, you are obliged to calculate, pay, and file the report to the Indonesia Tax Authority.

Many new businesses believe that because they are not earning any money or earning a profit, that they are exempt from tax reporting; however, you are still obliged to file a report with zero tax.

Please note that if you do not keep on top of your taxes, you could well be at risk or financial penalties, surcharges as well as (in extreme cases) imprisonment.

When to Arrange Payment File?

Corporate Tax reporting should be filed by the 20th of the following month and tax payments should be made the 15th of the following month.

Fully Inclusive Tax Packages

To make your life simpler, Lets Move Indonesia offers fully serviced packages to ensure your business operates smoothly. The All Inclusive Package takes care of your Monthly and Annual Reporting and saves you lots time, stress and money! To find out more details about the All Inclusive Package, Click Here!

Want to know more about income taxes in Indonesia? Then check out our useful guide!

If you need to know more or would like us to help with your tax reporting or other tax matters, then contact the Lets Move Indonesia team.

Our experienced team has years of tax experience and can help with your monthly & yearly tax reporting, individual tax reporting, as well as your payroll and accountancy needs.

T: 021 300 297 27 E: [email protected] Visit us in our office Bellagio Mall, Jl. Mega Kuningan Barat Kav.E4 No.3, Setiabudi, Jakarta 12930, Indonesia or fill in the contact form below!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia enters 2026 with renewed confidence and structural momentum. Macroeconomic stability, strong liquidity support, and continued reform efforts have positioned the country as one of Southeast Asia’s most compelling long-term investment destinations. At the same time, the regulatory and compliance environment for foreign investors has become more sophisticated, requiring careful planning across company incorporation, immigration, […]

Natalia Harfiana

01/02/2026

As a subsidiary of LMI Group, Lets Move Indonesia is proud to celebrate the new year by helping thousands of foreigners live, work, and thrive in Indonesia. 2026 marks another year of our journey, and we want to honour our clients by giving them a very special offer. For more than a decade, we’ve had […]

Lets Move Indonesia

12/30/2025

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Lets Move Indonesia

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Lets Move Indonesia

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025