- Home

- Visa Services

- Golden Visa Indonesia

Golden Visa Indonesia

Visa Services & Immigration Consulting

- Share:

Golden Visa Indonesia – Who is it for and what are the benefits

The laws and regulations regarding Indonesia’s Golden Visa are set out in the Minister of Law and Human Rights Regulation (Permenkumham) Number 22 of 2023 concerning Visas and Stay Permits. In Chapter V on Golden Visas, Article 184 explains the following:

The Golden Visa is a grouping of limited stay visas, limited stay permits, permanent stay permits, and re-entry permits for a certain period, namely a maximum of 5 or 10 years. The Golden Visa is granted for investment, family reunification, repatriation, and second homes.

The Golden Visa Indonesia is eligible for foreign investors to invest without having to establish a company in Indonesia.

Types of Golden Visa Indonesia Based on Validity

5-year Stay Visa

Foreign investors who do not intend to establish a company but wish to reside in Indonesia for 5 years must invest USD 350.000 (approximately IDR 5.3 billion). This investment can be used to purchase Indonesian government bonds, shares in public companies, or for savings/time deposits in banks.

- Scan a copy passport that is valid for at least 12 months

- Bank statement with a minimum amount of USD 5,000 or equivalent

- A recent Photograph with passport size (4x6)

- Curriculum Vitae

- Travel Itinerary (if any)

- Statement of commitment that must be fulfilled within 90 (ninety) days from the date of entry into Indonesia, such as:

- Purchase of Indonesian Government bonds worth USD 350.000 (three hundred fifty thousand US Dollars) for a stay period of up to 5 years or

- Purchase of shares or mutual funds in public companies in Indonesia worth USD 350.000 (three hundred fifty thousand US Dollars)

10-year Stay Visa

For a longer stay of 10 years, the required investment amount is USD 700.000 (approximately IDR 10.6 billion). This allows investors to benefit from greater investment opportunities and make a more substantial contribution to the Indonesian economy.

Requirements to Obtain the 10-years Indonesia Golden Visa

- Scan a copy Passport that is valid for at least 12 months

- Bank statement with a minimum amount of USD 5,000 or equivalent

- A recent Photograph with passport size (4x6)

- Curriculum Vitae

- Travel Itinerary (if any)

- Statement of commitment that must be fulfilled within 90 (ninety) days from the date of entry into Indonesia, such as:

- Purchase of Indonesian Government bonds worth USD 700.000 (seven hundred US Dollars) for a stay period of up to 10 years or

- Purchase of shares or mutual funds in public companies in Indonesia worth USD 700.000 (seven hundred US Dollars) for a stay period of up to 10 years or

- Purchase of a flat or apartment worth at least US$1,000,000 (one million US Dollars) for a stay period of up to 10 years.

Other Types of Golden Visa Indonesia

Aside from the common Golden Visa E28C, there are more options of Golden Visa that can be chosen based on the purpose.

Individual Investors Establishing a Company in Indonesia

- Five-Year Visa: For a 5-year stay, individual foreign investors planning to set up a company in Indonesia must invest a minimum of USD 2.5 million (approximately IDR 38 billion). This investment can be in the form of share purchases, company establishment, or other investment activities that support the local economy.

- Ten-Year Visa: For those who wish to stay for 10 years, the investment requirement increases to USD 5.000.000 (approximately IDR 76 billion). This investment aims to ensure a long-term impact on the Indonesian economy.

Corporate Foreign Investors

- Five-Year Visa: Corporate investors, including directors and commissioners, who wish to stay for 5 years in Indonesia must establish a company and invest USD 25.000.000 (approximately IDR 380 billion). This investment aims to support job creation and economic growth through significant company establishment.

- Ten-Year Visa: For a 10-year stay, the investment requirement is USD 50.000.000 (approximately IDR 760 billion). This demonstrates a greater commitment to have a broader and more sustainable economic impact.

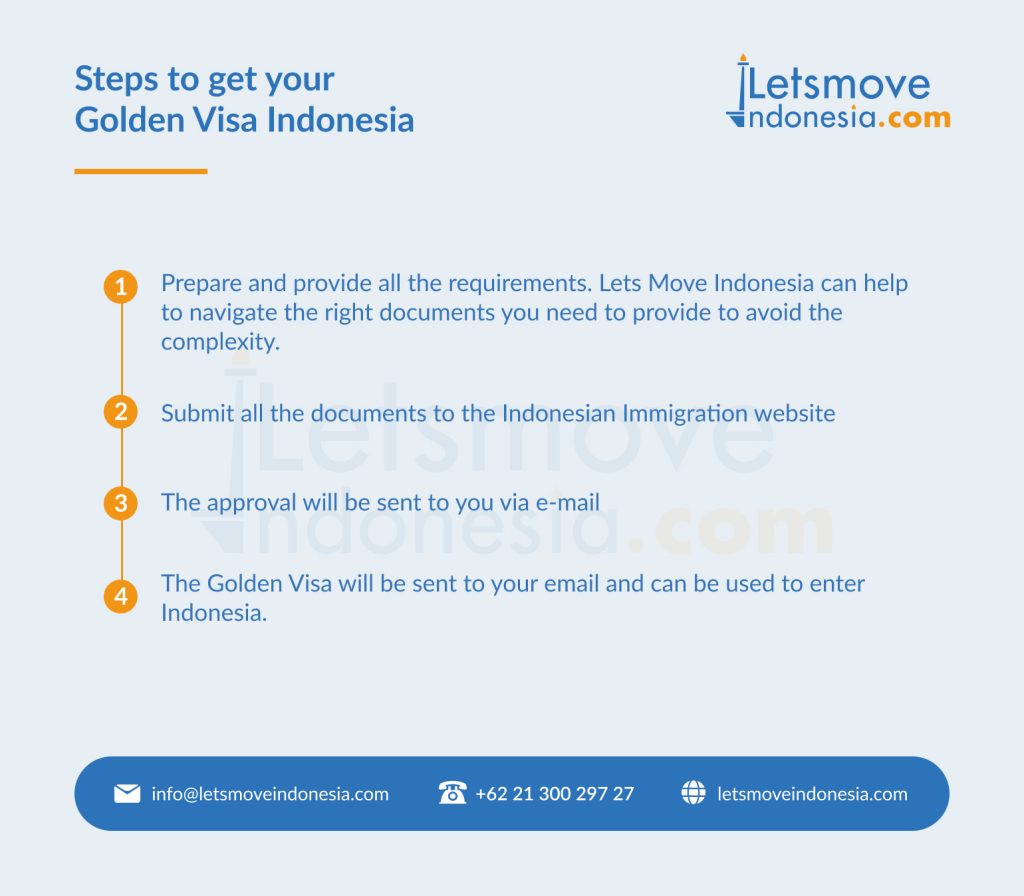

Steps to get your Golden Visa Indonesia

- Prepare and provide all the requirements. Lets Move Indonesia can help to navigate the right documents you need to provide to avoid the complexity.

- Submit all the documents to the Indonesian Immigration website

- The approval will be sent to you via e-mail

- The Golden Visa will be sent to your email and can be used to enter Indonesia..

Common Questions About Indonesia Golden Visa

Is Golden Visa Extendable?

Yes, the visa holders can extend their Golden Visa for certain periods. Speak to our Visa Consultants to learn more about the recent Golden Visa Indonesia.

Can I include my family in my Golden Visa application?

Yes, the Golden Visa allows for the inclusion of dependents (spouse and children) under certain conditions.

What are the tax implications of holding a Golden Visa?

Golden Visa holders are still subject to Indonesian tax laws, but there might be certain tax incentives or benefits depending on your investment activities.

Can I work remotely for a foreign company while holding a Golden Visa?

Yes, the Golden Visa is designed to attract foreign talent, including remote workers, as long as you meet the income requirements.

Are there any restrictions on where I can live or travel within Indonesia with a Golden Visa?

Golden Visa holders have the freedom to live and travel anywhere within Indonesia.

Golden Visa Indonesia

Want to know more about similar Visa options? Check out some of the other Indonesia Visas below:

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of our popular Indonesia Visa services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

As a subsidiary of LMI Group, Lets Move Indonesia is proud to celebrate the new year by helping thousands of foreigners live, work, and thrive in Indonesia. 2026 marks another year of our journey, and we want to honour our clients by giving them a very special offer. For more than a decade, we’ve had […]

Lets Move Indonesia

12/30/2025

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Lets Move Indonesia

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Lets Move Indonesia

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025