- Home

- Tax Services

- Electronic Tax Certificate in Indonesia (Digital Certificate)

Electronic Tax Certificate in Indonesia (Digital Certificate)

Tax & Accountancy Services

- Share:

Tax & Accountancy Services

Indonesia’s digital tax ecosystem, businesses and individuals are now required to use an E-Certificate (Sertifikat Elektronik) to securely access and authenticate activities within the Directorate General of Taxes (DGT) system.

If you are a business owner, PT PMA investor, or an expatriate working in Indonesia, obtaining your Electronic Certificate is a mandatory security measure to carry out key tax transactions and digital filings.

This document acts as your digital identity and electronic signature, ensuring your online tax submissions are verified, encrypted, and protected according to Indonesian law.

What Is an Electronic Certificate?

A Sertifikat Elektronik or Surat Keterangan Digital in Indonesia is an official digital signature issued by the local Tax Authority that verifies the legal identity of the tax resident in electronic transactions.

This official document provides secure access to tax services and replaces simple logins such as NPWP + password. This offers higher protection and prevents misuse, such as data manipulation, fraud, or unauthorized access.

Why Do You Need an Electronic Certificate in Indonesia?

It enables you to:

- Secure login to the Indonesian tax system (higher-level access)

- Submit monthly & annual tax returns (SPT) electronically

- Digitally sign tax filings with no physical signature required

- Request tax refunds, SKB (Tax Exemption Certificate), and other applications

- Issue and replace e-Invoices (e-Faktur) where applicable

- Prevent document forgery, data tampering, and unauthorized actions

If you operate a business in Indonesia, particularly a PT PMA, obtaining your Electronic Certificate is essential for safe, efficient, and compliant tax management.

When Should You Apply?

You must arrange the document as soon as your tax profile is activated (NPWP & CoreTax registration).

Many new businesses assume they only need the certificate once generating revenue; however, it is needed from the beginning of their tax obligations to avoid delays and penalties.

Without an E-Certificate, you cannot complete key online tax processes, including filing returns.

Electronic Certificate Service Assistance by Lets Move Indonesia

Scope of Services

- Processing & issuance of Electronic Certificate / Digital Certificate

- Compliance assistance and submission to the tax office (KPP)

- Guidance to ensure a smooth application

- Support for CoreTax account validation (as required)

Required Documents to Obtain Tax E-Certificate

Please prepare the following documents:

- Active email address + password

- KTP/KITAS/KITAP (original & copy)

- NPWP (original & copy)

- Selfie photo (with ID)

- PIC registered in CoreTax system

- Additional documents

FAQs

Is a Digital Certificate mandatory in Indonesia?

Yes. It is required under Indonesian tax regulations to ensure secure access, identity verification, and tax compliance. It is compulsory for taxation – related business activities, such as conducting income tax reporting or cross-border activities governed by treaty rules and tax residency status.

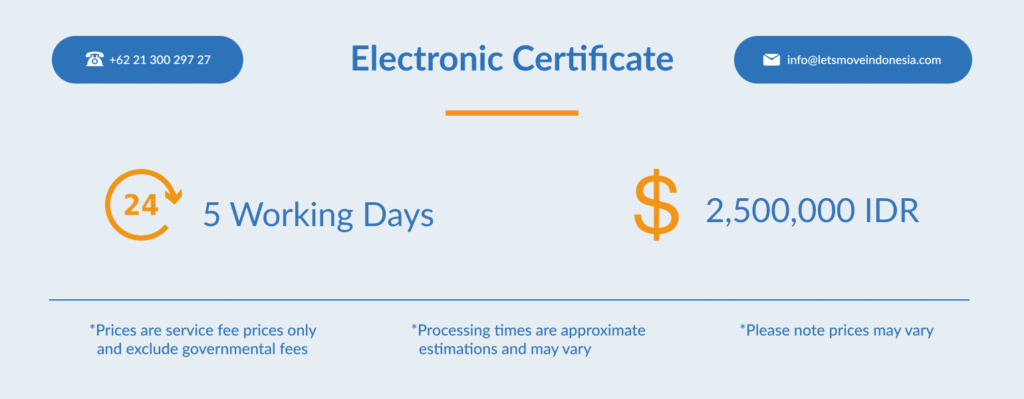

How long does it take to obtain an Electronic Certificate?

The processing time is approximately five working days after all required documents are submitted and validated. Completing the application accurately helps facilitate faster approval from the Directorate General of Taxes (DGT).

What happens if I lose access to my Digital Certificate?

If you lose access or your certificate becomes unusable, you must request re-issuance through the DGT. Lets Move Indonesia can support you through the reactivation process to ensure uninterrupted tax reporting and compliance with residency and entity obligations.

Is the Electronic Certificate the same as an EFIN?

No. An EFIN is a unique taxpayer identification tool used to register and access the DJP Online.

How long is the validity period of the Electronic Certificate?

The Digital Certification is generally valid for two years from the issuance date. After expiry, taxpayers must renew it according to current tax regulations.

Need assistance with Tax Compliance in Indonesia?

Understanding the local tax system can be complex, especially for foreign investors and expatriates. Our team ensures your compliance processes are efficient, secure, and stress-free.

With years of experience supporting PT PMA, expatriates, and corporate clients across Indonesia, we are here to help you stay compliant and focus on your business, while we handle the rest.

Our specialists are ready to assist you with digital tax access, monthly reporting, annual filings, and corporate compliance.

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Natalia Harfiana

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Natalia Harfiana

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025