- Home

- Tax Services

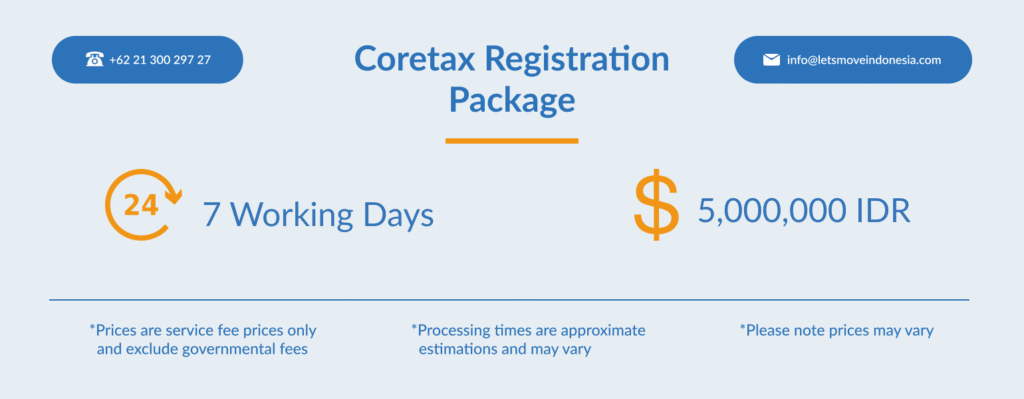

- Core Tax Registration Services

Core Tax Registration Services

Tax & Accountancy Services

- Share:

Tax & Accounting

With the launch of the Core Tax Administration System (Coretax / PSIAP), businesses and individuals are now required to transition into the new unified digital tax platform managed by the Direktorat Jenderal Pajak (DJP).

Coretax replaces multiple legacy systems such as e-Filing, e-Faktur, e-Billing, e-Registration, and consolidates every tax function into one portal, including:

- NPWP registration & updates

- SPT filing (monthly & annual taxes)

- Tax payments and billing

- Certificate Electronic issuance (E-Certificate)

- Audit process & correspondence with tax authority

Launched on 31 December 2024 and fully active from January 2025, Coretax marks a major shift towards a fully digital, integrated tax reporting ecosystem in Indonesia, developed to enhance the efficiency, accuracy, and transparency of tax compliance processes.

Why Coretax Matters

If you run a business or hold KITAS/KITAP in Indonesia, understanding the Coretax system is critical. Without Coretax enrollment, corporate taxpayers may be unable to:

- File tax reports (SPT)

- Make tax payments

- Issue or validate faktur pajak perusahaan (tax invoices)

- Submit tax objection, refund request, or SKB (tax exemption)

- Register or update NPWP / NIK

- Access the DJP digital services on www. pajak. go. id

Failure to transition into Coretax can lead to reporting delays, penalties, and operational disruptions. LMI Consultancy ensures you are registered correctly and quickly, without the hassle.

Lets Move Indonesia Coretax Registration Service Includes

Service | Description |

|---|---|

Company Coretax Registration | Register your entity in the Coretax system |

Director / PIC Coretax Registration | Coretax registration for 1 Director/PIC (required for company access) |

PIC Certificate Electronic (E-Certificate) | Secure digital signature for online tax submissions |

Note: Every company must have at least one active PIC registered in Coretax with a valid electronic certificate.

Required Documents

For Company

Company email & login access to the DJP portal.

For Director / PIC

- Email & password

- KTP & NPWP (Indonesian PIC)

- Passport & KITAS/KITAP (Foreign PIC)

- Passport photo

- A selfie holding a passport

- Additional documents may be requested

Note: PIC must already be registered in Coretax before E-Certificate issuance.

Register for The Coretax System with Lets Move Indonesia

Managing Indonesian digital tax systems can be confusing, and the process can be time-consuming and frustrating.

As a reliable partner of Business Registration and Compliance in Indonesia, Lets Move Indonesia offers you tailored Coretax consultation and easy solutions to your transition to the Coretax administration system in Indonesia.

- Dedicated tax compliance specialists

- Fast processing & clear instructions

- Hands-off digital submission

- Support in English & Bahasa Indonesia

- Peace of mind knowing your business remains compliant

We ensure seamless Coretax activation and minimize disruption to your tax reporting obligations.

Don’t wait until reporting deadlines cause unnecessary penalties or system blocks. Transition to the new Coretax system with confidence and expert support.

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Natalia Harfiana

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Natalia Harfiana

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025