Setting up a company in Indonesia has never been more attractive. As Southeast Asia’s largest economy, Indonesia continues to welcome foreign investment across key sectors, supported by streamlined licensing procedures, digital submissions via the Online Single Submission (OSS RBA) system, and clearer regulations governing foreign ownership.

For investors exploring opportunities in this dynamic market, understanding the differences between PT PMA, PT, and Representative Office structures is essential. Each legal entity comes with its own requirements, limitations, and strategic advantages depending on your business goals, investment commitments, and desired operational scope.

This article provides the latest, comprehensive breakdown of these business entities and guides you through the company registration process in Indonesia.

Types of Company Registrations in Indonesia

Indonesia offers several legal structures tailored for both local and foreign investors according to your business needs. The three most relevant for international entrepreneurs are:

- PT PMA (Perseroan Terbatas Penanaman Modal Asing) – A foreign-owned limited liability company.

- PT (Perseroan Terbatas) – A locally owned limited liability company, with limited openings for foreign shareholders under specific circumstances.

- Representative Office (Kantor Perwakilan Perusahaan Asing / KPPA) – A non-revenue-generating liaison office for foreign parent companies.

Each serves different purposes depending on ownership, long-term plans, and the type of business activities you intend to conduct.

1. PT PMA (Foreign-Owned Company)

A PT PMA is the primary vehicle for foreign investors to legally conduct business, generate revenue, hire employees, and hold assets in Indonesia.

What Is PT PMA?

PT PMA stands for Foreign Direct Investment Limited Liability Company. It is regulated by the Ministry of Investment / BKPM and permits up to 100% foreign ownership, depending on the business classification as specified in the Positive Investment List (Daftar Investasi Prioritas) under Presidential Regulation No. 49/2021—currently replacing the former Negative Investment List (DNI).

Key Characteristics

- Foreign shareholders (individuals or foreign companies) allowed.

- Can engage in commercial and operational activities.

- Can issue invoices under the company’s Indonesian tax ID (NPWP).

- Must comply with minimum capital requirements.

Minimum Capital Requirements (Updated 2025)

The typical requirement remains:

- IDR 10 billion minimum issued capital

- Recommended: IDR 2.5 billion paid-up capital, declared during incorporation

- No need to deposit funds upfront, but must be financially reasonable and provable for business operations.

Certain industries, particularly those in construction, mining, logistics, or high-technology, may require higher capital.

Benefits of Establishing a PT PMA

Setting up a PT PMA provides the following advantages:

- Full legal ability to operate commercially in Indonesia

- 100% foreign ownership in many permitted sectors

- Eligibility to apply for Investor KITAS (stay permit without requiring a work permit)

- Ability to open local bank accounts, apply for business licenses, and import goods

- Increased trust and recognition among Indonesian partners, clients, and suppliers

PT PMA Registration Requirements

To incorporate a PT PMA, you must:

- Prepare a company deed drafted by a notary

- Establish a registered office (physical or virtual office)

- Appoint minimum 2 shareholders, 1 director, and 1 commissioner

- Select business activities using KBLI codes (Indonesia’s official business classification)

- Obtain a Business Identification Number (NIB) through OSS

- Secure operational & commercial licenses (if required)

Once the PT PMA is active, it must also obtain:

- NPWP (Tax Number)

- Business licenses relevant to its sector

- Employment reporting for foreign workers (if any)

2. PT (Local Company)

A PT, or local limited liability company, is the entity used by Indonesian citizens or legal entities. While primarily intended for locals, foreigners can still participate under certain conditions.

When Can Foreigners Use a PT?

- When partnering with Indonesian shareholders

- When the business sector does not permit foreign ownership

- When the structure is used strategically (with legal safeguards) to meet ownership rules

Benefits of Establishing a PT

- Highly trusted by government and private sectors

- Full access to projects, tenders, and procurement

- Considered stable and legally compliant under Kemenkumham (Ministry of Law & Human Rights)

- Lower capital requirements compared to PT PMA for smaller classifications (UMK/UMKM)

Key Differences Between PT and PT PMA

| Aspect | PT (Local Company) | PT PMA (Foreign-Owned) |

| Ownership | 100% local or mixed (limited) | Up to 100% foreign |

| Capital | Flexible, tiered by business scale | Minimum IDR 10B |

| Activities | Must comply with foreign ownership restrictions | Broader options for foreigners |

| Investor Visa | Not available | Available |

| Perception | Strong for local projects | Preferred for multinational operations |

Also read: Comprehensive Guide to Set up a PT PMA in Indonesia

3. Representative Office (KPPA)

A Representative Office allows foreign companies to establish a presence in Indonesia without engaging in profit-making activities.

This is perfect for companies that want to explore the market before committing to full incorporation.

What RO Can Do

- Conduct market research

- Coordinate with Indonesian partners

- Promote the parent company

- Manage communication, quality control, sourcing

- Lease office space and hire local staff

- Apply for KITAS for foreign executives

What They Cannot Do

- Generate revenue

- Issue invoices

- Sign commercial contracts domestically

- Participate in tenders

Types of Representative Offices in Indonesia

Under BKPM Regulation No. 13/2017, the following RO categories exist:

- KPPA: General Representative Office

- KP3A: Representative Office for Trade Companies

- BUJKA: Representative Office for Construction Services

- KPPA MIGAS: For Oil & Gas entities

Benefits of Opening a RO

- No minimum capital requirement

- Faster setup process than PT PMA

- Allows foreign companies to legally hire staff and operate administratively

- Can open local bank accounts

- Ideal for testing the market before setting up a full company

Using a Virtual Office for Company Registration

A virtual office is a popular and fully legal option for company registration in Jakarta and Bali. It allows companies to:

- Register their PT PMA, PT, or RO

- Obtain a legitimate business address

- Save operational costs

- Maintain professionalism

Lets Move Indonesia provides compliant virtual office solutions accepted by OSS and government regulators.

Company Registration Process in Indonesia (Step-by-Step of Company Incorporation)

(Updated for OSS RBA system 2025)

Setting up a company in Indonesia involves several structured stages:

1. Choose Your Business Structure

Decide whether a PT PMA, PT, or Representative Office suits your goals. Consider:

- Ownership structure

- Business activities

- Capital investment capacity

- Long-term plans

2. Select Company Name

Names must:

- Consist of 3 unique words

- Not resemble existing Indonesian companies

- Use the Latin alphabet

- Avoid restricted terms (e.g., banking, finance unless licensed)

3. Prepare the Company Deed

A notary drafts the Deed of Establishment, which includes:

- Shareholder details

- Director and commissioner appointments

- Company address

- Capital structure

- Business activities (KBLI)

The deed is then legalized by Kemenkumham.

4. Obtain NIB (Business Identification Number)

Your NIB serves as:

- Company registration number

- Importer registration (if enabled)

- Your basic business license

The OSS RBA system assigns risk-level classifications (low, medium, high) which determine licensing requirements.

5. Secure Operational & Commercial Licenses

Depending on the business, additional permits may include:

- Tourism licenses

- Trading (SIUP)

- Industrial licenses

- Construction permits

- Health & food distribution permits (BPOM)

- Finance/Fintech approvals

6. Tax Registration (NPWP)

All companies must have:

- NPWP (Tax Identification Number)

- NPPKP (VAT Registration) if applicable

Tax reporting is conducted monthly and annually.

7. Apply for Visas or Work Permits

Foreign directors or investors may apply for:

- Investor KITAS (No work permit required)

- Working KITAS (RPTKA + Work Permit)

Setup Business in Indonesia Now with Company Registration Services From Lets Move Indonesia

Under LMI Consultancy’s umbrella, LetsMoveIndonesia benefits from extensive operational resources, in-depth regulatory insight, and a nationwide network of legal and administrative specialists. This synergy allows us to deliver high-quality assistance across multiple areas, including company registration, visas and stay permits, compliance management, tax support, business licensing, and virtual office solutions. By integrating LMI’s proven methodologies with modern, client-friendly service delivery, we ensure that every foreign individual or corporation receives reliable guidance backed by deep industry expertise.

Together with LMI Consultancy, LetsMoveIndonesia continually invests in improving Indonesia’s expat experience and business environment. As a unified group, we advocate for fair, transparent processes and contribute to shaping a more accessible investment climate for global entrepreneurs. Our shared mission is simple: to provide the most trusted, efficient, and ethical consultancy services in Indonesia—helping clients not only enter the market but thrive within it. Whether establishing a PT PMA, opening a representative office, applying for visas, or exploring long-term opportunities, our combined team delivers solutions that are accurate, compliant, and tailored to each client’s needs.

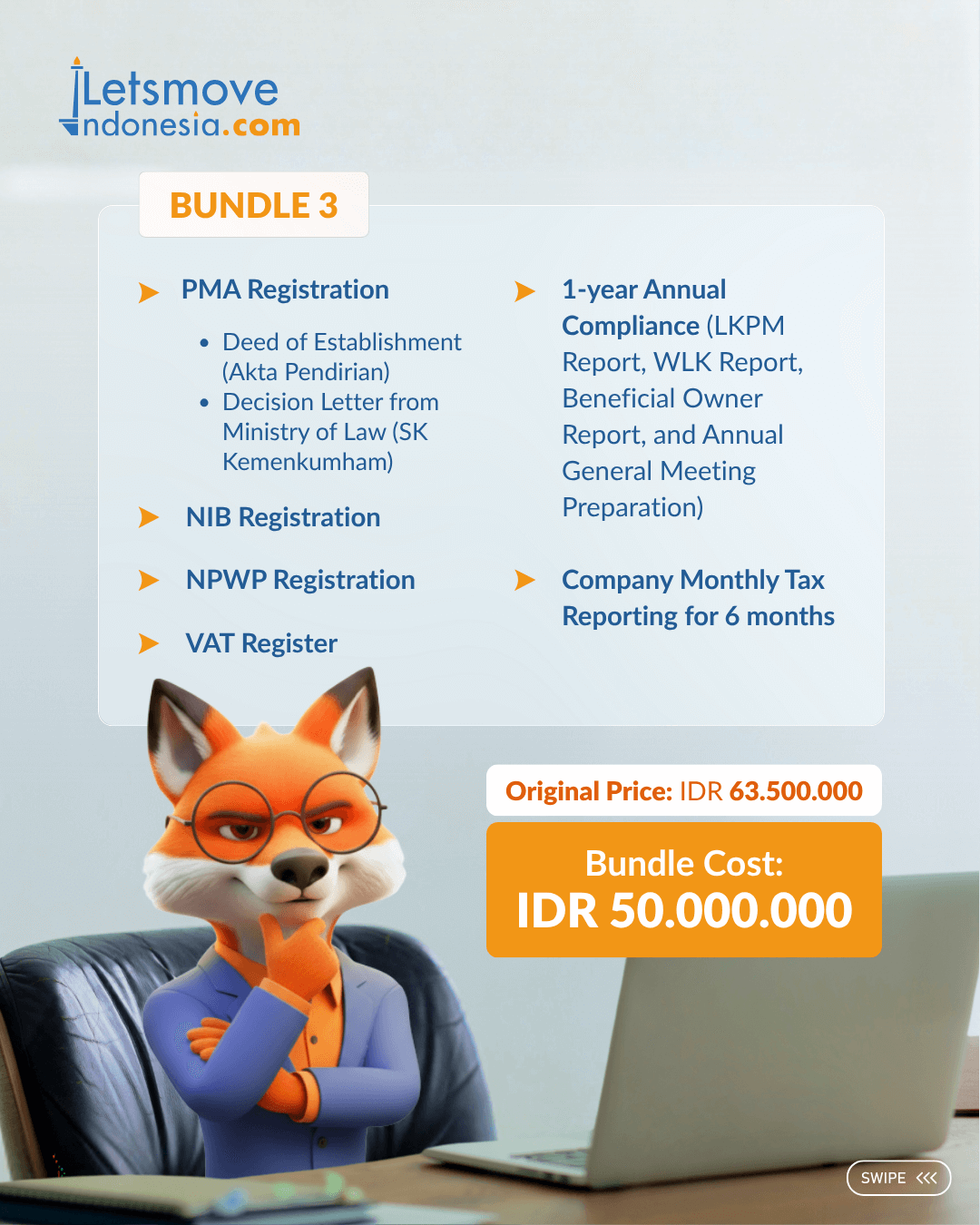

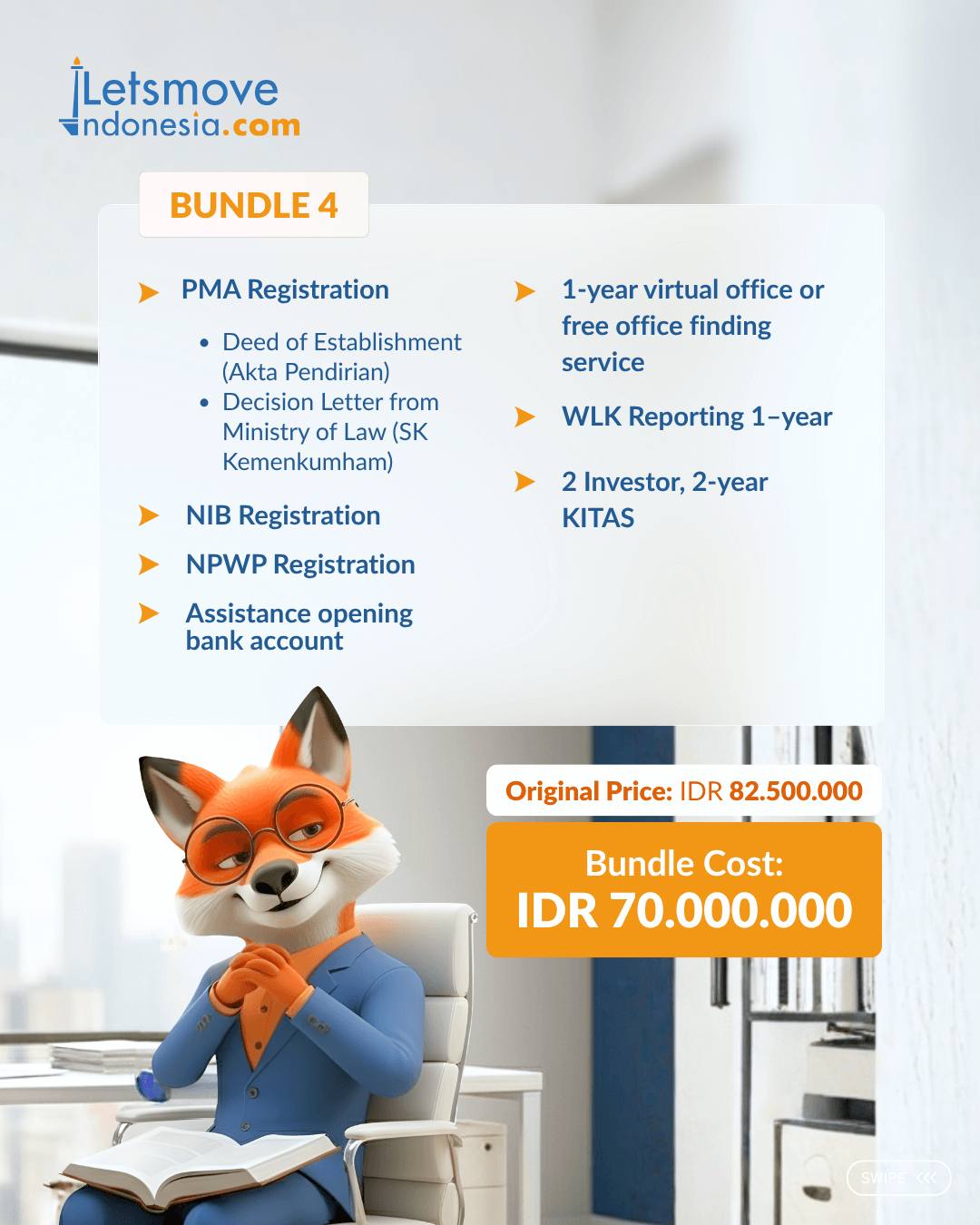

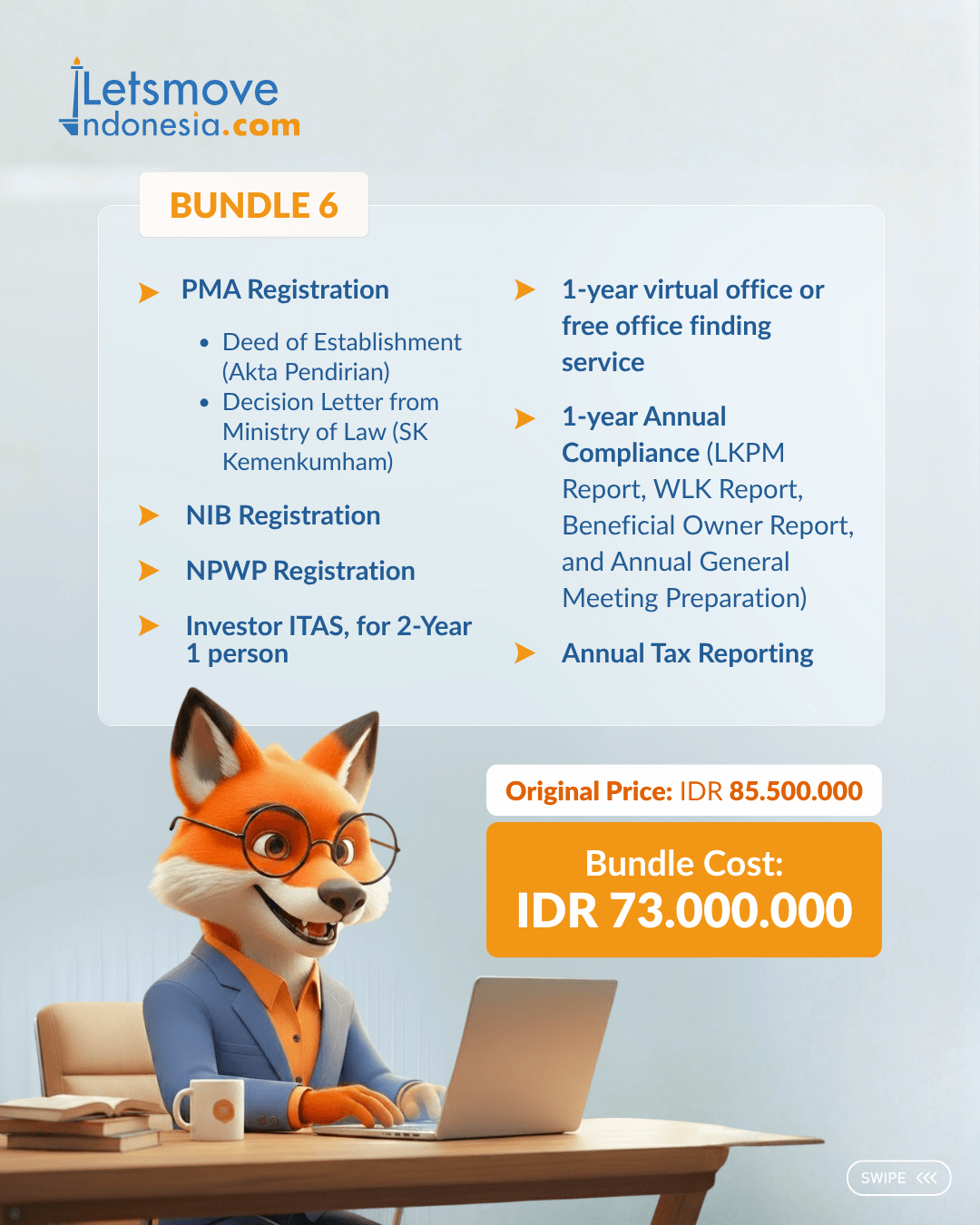

Lets Move Indonesia specializes in:

- PT PMA Registration

- Indonesian PT Establishment

- Representative Office Setup

- Visa & KITAS Services

- Virtual Offices in Jakarta & Bali

- Business Licensing & Tax Registration

Our team ensures a fast, transparent, and stress-free process—so you can focus on growing your business.