- Home

- Tax Services

- Indonesia Tax Training & Accounting Course

Indonesia Tax Training & Accounting Course

Tax & Accountancy Services

- Share:

Navigating the complexities of tax obligations while expanding business worldwide can be a daunting task. That’s why Lets Move Indonesia is proud to offer a comprehensive tax training program designed to demystify the Indonesian tax landscape.

Tax in Indonesia

Tax (pajak) refers to a mandatory financial contribution levied by the government on individuals, business organization, and other entities. This revenue is crucial for funding public services, infrastructure development, and various government initiatives.

Tax education or pelatihan pajak plays a pivotal role in fostering a culture of tax compliance. By providing individuals and businesses with a clear understanding of their tax obligations, it empowers them to fulfill their responsibilities accurately and on time.

Our Training Programme

Our solutions covers a wide range of essential topics, including:

- Types of Taxes: Gain a clear understanding of the various taxes applicable in Indonesia, such as income tax, value-added tax (VAT), and withholding tax.

- Payment Structures and Deadlines: Learn about the different tax payment structures, deadlines, and penalties for non-compliance.

- Company Tax Obligations: Understand the specific tax obligations for businesses, including filing requirements and record-keeping.

- Recent Tax Regulations: Stay updated on the latest tax regulations and their implications for your business.

- Tax Compliance Strategies: Develop effective strategies to ensure your business remains compliant with Indonesian tax laws.

We understand that your time is valuable. That’s why we offer flexible training options to suit your needs:

In-Person Training: Our experienced tax professionals can conduct training sessions at your company’s premises, providing personalized guidance and addressing your specific concerns.

Virtual Training (Conference Call): If you prefer a remote learning experience, we also offer virtual training sessions via conference call, allowing you to participate from anywhere in the world.

By participating in our program, you and your team will gain the knowledge and skills needed to:

Minimize tax risks: Avoid costly penalties and legal complications by ensuring your business remains compliant with Indonesian tax regulations.

Optimize tax efficiency: Identify potential tax-saving opportunities and implement effective tax planning strategies.

Enhance financial management: Improve your overall financial management by understanding the tax implications of your business decisions.

Empower your tax professionals with the knowledge and skills they need to navigate complex tax system. Contact Lets Move Indonesia today to learn more about our training program and how we can help your business achieve tax compliance and efficiency.

The Indonesia Tax Training include these services:

Training of Tax Variances in Indonesia, such as: Income Tax article 21, Withholding Tax article 21, 23 / 26, 4(2), and VAT

Supporting materials for the training will be prepared in Bahasa or English

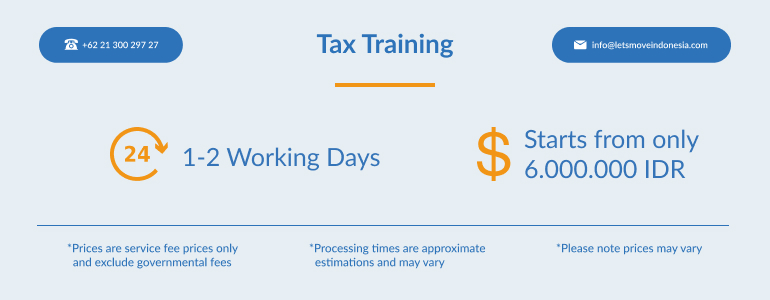

Price is 6 Million IDR and include all materials. Timeframe is generally between 1-2 hours.

Fully inclusive Tax & Accountancy Packages

Lets Move Indonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business operates smoothly at a cost-effective price. To find out more about our packages, click here!

Have a question about our Tax & Accountancy services? Then contact the Lets Move Indonesia team for your free 1-hour consultation T: 021 300 297 27 E: [email protected] or visit us in the Lets Move Indonesia office, located in The Bellagio Mall, Mega Kuningan – The only walk in Agency in Jakarta!

Frequently Asked Questions

What are the tax rates for individuals and corporations in Indonesia?

- Individuals: Progressive rates ranging from 5% to 35% based on taxable income.

- Corporations: A flat rate of 22%, with potential reductions for specific industries or small businesses.

What is the tax year in Indonesia?

The tax year in Indonesia follows the calendar year, from January 1st to December 31st.

How do I file a tax return?

Tax returns can be filed online through the Directorate General of Taxes (DGT) e-filing system or manually at a local tax office.

What are the penalties for late tax filing or non-compliance?

Penalties can include fines, interest charges, and even criminal prosecution in severe cases of tax evasion.

What is the cost of your tax course and training?

The pricing for our tax courses and training varies depending on the specific programme, duration, and delivery method. Please contact us directly for a personalized quote based on your requirements.

Do you offer online training?

Yes, we provide professional online tax courses, allowing you to learn at your own pace and convenience.

Can you assist with tax audits and disputes?

Yes, our konsultan pajak can provide guidance and representation during tax audits and disputes.

Do you offer customized tax course for specific industries or organizations?

Absolutely, we can tailor our tax course programs to meet the unique needs of your industry or organization.

How can I stay updated on the latest tax rules in Indonesia?

We offer regular updates on tax rules through our website, newsletters, and social media channels. You can also subscribe to our mailing list to receive timely information.

Want to know more? Then check out these useful articles about Tax & Company Establishment in Indonesia!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

Indonesia’s tourism sector has surged dramatically in recent years, reshaping the country’s immigration landscape and intensifying the spotlight on lawful stay and compliance. According to Statistics Indonesia (BPS), the country recorded approximately 13.9 million international visitor arrivals in 2024, up roughly 19% year-on-year and the highest total since the pre-pandemic era. For Australians in particular, […]

Natalia Harfiana

12/22/2025

Overseas Indonesians, commonly referred to as the Indonesian diaspora, are individuals of Indonesian origin living abroad. In many cases, members of this group have lost their Indonesian citizenship as a result of naturalization in another country, which means they are legally considered foreign nationals and are required to obtain the appropriate visa or stay permit […]

Natalia Harfiana

12/16/2025

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025