- Home

- Tax Services

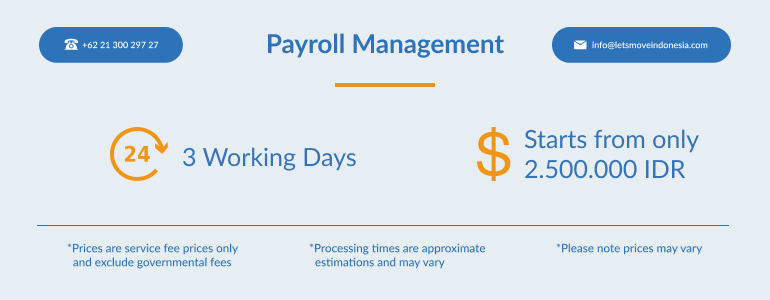

- Outsource Payroll Management

Payroll Outsourcing Service in Indonesia

Tax & Accountancy Services

- Share:

Payroll processing is one of the most challenging parts of running a business and is extremely time consuming for business owners. At Lets Move Indonesia, we specialize in ensuring your company operates smoothly and stress free, allowing you to focus on making your business grow.

Payroll is processed in a series of steps to ensure that employees are paid accurately and on time, while also complying with the country’s complex tax and social security regulations.

Our payroll services focus on helping you calculate gross wages, subtract all pertinent withholdings and deductions, print pay slips and prepare all employment tax filings.

Our Outsource Payroll Management Service Includes:

- Monthly Payroll calculation in accordance with the provision of the Labour Laws

- Income Tax article 21 preparation and submission

- Salary slip preparation and printing (if required)

- Our basic payroll service is for up to 10 employees, for additional employees there will be additional charge of IDR 100.000 / person

- Help with ad hoc inquiries

Methods of Payroll Outsourcing Services in Indonesia

- Manage Payroll using Payroll management software

- Manual Payroll Process

Required Documents

- List of employees data (employee numbers, NPWP, Status permanent/non permanent, marital status, position, grade (if any), Bank account details (number, name of bank, name of beneficiary)

- Payroll details including basic salary, monthly allowances, bonus or incentives (if any)

- Certificate of BPJS Ketenagakerjaan and Kesehatan

- List of temporary benefits

- List of allowances (if any)

- List of reimbursements (if any)

- List of load deductions (if any)

- Additional documents may be requested

Fully inclusive Tax & Accountancy Packages

Lets Move Indonesia is proud to offer a variety of exclusive Tax & Accountancy packages to ensure your business operates smoothly at a cost-effective price. To find out more about our packages, Click Here!

Have a question about our Tax & Accountancy services? Then contact the Lets Move Indonesia team for your free 1-hour consultation T: 021 300 297 27 E: [email protected] or visit us in the Lets Move Indonesia office, located in The Bellagio Mall, Mega Kuningan – The only walk in Agency in Jakarta!

Frequently Asked Questions

What are manual payroll and tax management services?

These services involve a dedicated team or individual who handles all aspects of payroll and tax calculations, payments, and filings manually, without relying on automated software or systems.

Why would a company choose manual payroll and employee tax management services over automated payroll software?

Some companies, particularly smaller ones or those with unique payroll structures, may prefer manual services due to their perceived greater flexibility and personalized attention rather than using payroll software. There may also be concerns about the initial cost and complexity of implementing payroll management system.

Why would I need manual payroll and tax management services when I already have automated payroll system?

While automated payroll software streamlines many aspects of payroll processing, it’s not always a one-size-fits-all solution. Manual services provide expert oversight and personalized support, especially crucial when dealing with:

- Indonesian tax laws are intricate and subject to frequent changes.

- Manual services ensure accurate calculations and compliance, minimizing the risk of errors and penalties.

- Expatriate employees, special benefits, or unusual deductions often require manual intervention to ensure correct payroll management process.

- A local payroll tax consultant like Lets Move Indonesia has in-depth knowledge of Indonesian labour laws and tax regulations, ensuring you run payroll and tax management properly.

- Outsourcing payroll and tax management frees up your time and resources, allowing you to focus on your core business activities.

What specific services are included in manual payroll and tax management?

- Calculate payroll manually helps allocating personalized payroll function for gross and net salaries, including deductions for taxes, social security contributions, and other benefits.

- Preparing and submitting all necessary tax forms and reports to the Indonesian tax authorities on your behalf.

- Ensuring your payroll and tax practices adhere to all relevant Indonesian regulations.

- Answering employee inquiries related to payroll and taxes.

- Handling the complexities of payroll for expatriate employees, including tax equalization and compliance with international

- regulations.

Can Lets Move Indonesia help me handle payroll software and manual payroll services?

We do not have official collaboration with any Payroll and HR Management software for now, we can assist you in selecting the right payroll software for your business and provide ongoing manual support to ensure accurate and compliant payroll and tax management.

How do I get started with Lets Move Indonesia's payroll and tax management services?

Contact us today for a consultation. We’ll assess your company’s needs and provide a customized solution that fits your requirements and budget.

Manage Payroll calculation with Lets Move Indonesia

With ever-changing regulations, tax laws, and employee benefits, ensuring accurate payroll calculations is crucial for maintaining compliance and employee satisfaction.

Lets Move Indonesia offers a complete payroll solution to manage your payroll effectively and alleviate the administrative burden. Our team of experienced finance specialists meticulously handles all aspects from payroll data collection and calculations to tax deductions and payslip generation to make the payroll process becomes easier.

Want to know more? Then check out these useful articles about Tax & Company Establishment in Indonesia!

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025

From manufacturing and logistics to digital platforms and professional services, the country’s expanding economy offers immense potential for both local entrepreneurs and global investors. Thousands of business owners each year face challenges in navigating company registration, licensing requirements, and compliance obligations. The reality is that many agencies offering “company setup services” lack transparency, provide unclear […]

Lets Move Indonesia

11/28/2025

Indonesia continues to evolve into one of Southeast Asia’s most dynamic economic landscapes, with rapid digitalisation, growing industries, and an increasingly sophisticated regulatory environment. But as the system becomes more advanced, Indonesia’s tax landscape also becomes more complex. Constant updates, new reporting systems, and shifting regulations mean thousands of individuals and businesses struggle to stay […]

Lets Move Indonesia

11/28/2025