- Home

- Tax Services

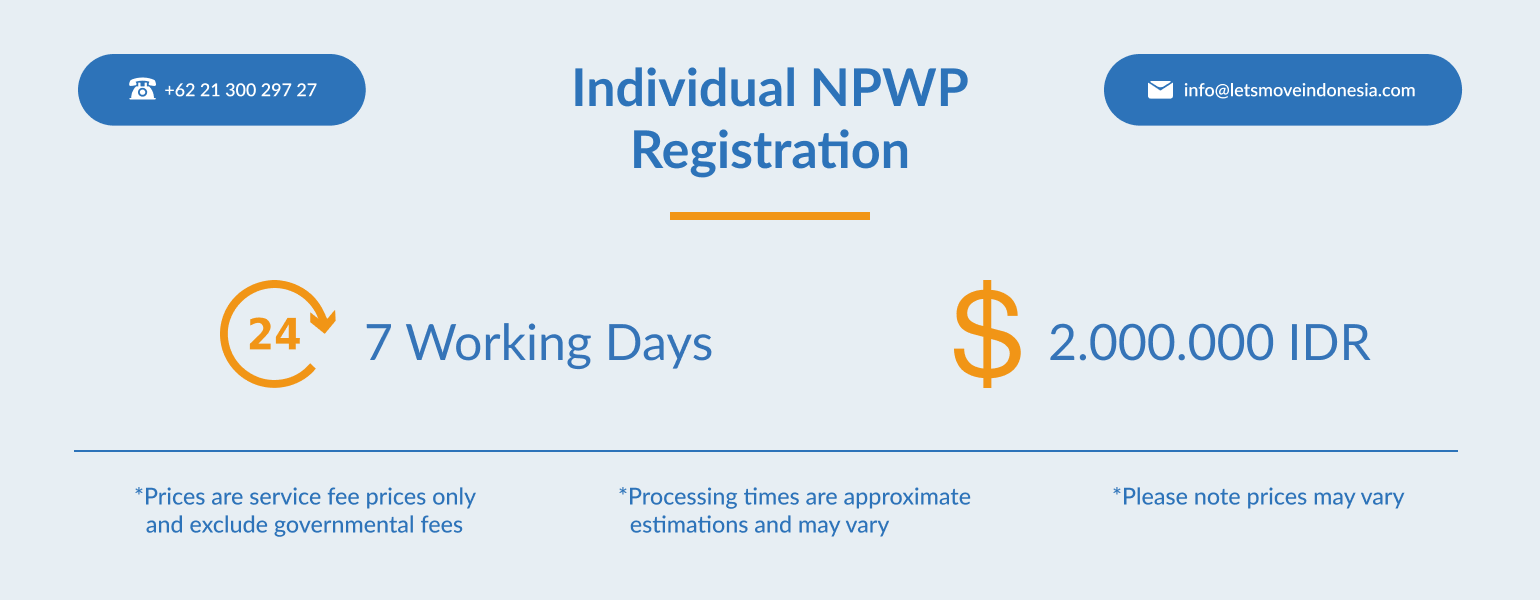

- Individual NPWP Registration

Individual NPWP Registration

Tax & Accountancy Services

- Share:

Individual NPWP Registration – Who is it for and what are the benefits

The Personal NPWP Card is as essential as the Identity Card (KTP). NPWP must be owned by people who have fulfilled certain requirements.

Taxpayer Identification Number or NPWP is a number given to taxpayers that will be used as a personal identification or identity of taxpayers in carrying out their rights and obligations in tax affairs. NPWP must be owned by Indonesian citizens, both individuals and business entities.

The Personal NPWP Card can be said to be as important as the Identity Card (KTP). NPWP must be owned by people who have fulfilled certain requirements, including expatriates who live in Indonesia.

If you are an expat and planning to live or work in Indonesia, it is mandatory for you to register for an NPWP. Registering your NPWP through LetsMoveIndonesia will save you time and hassle. We will help provide guidance through the document preparation and submitting your them so you would not have to go the extra mile to make sure the process runs smoothly.

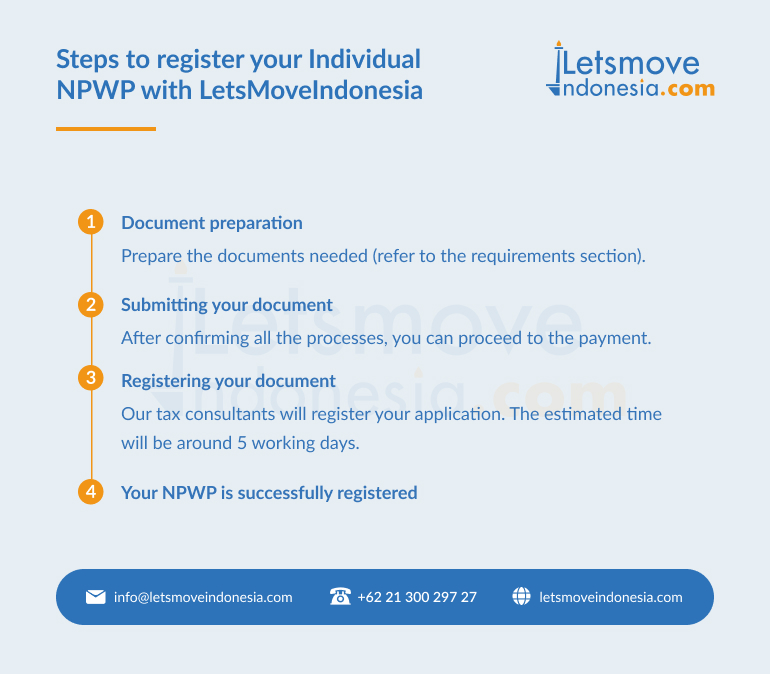

Steps to register your individual NPWP with Lets Move Indonesia

Prepare the documents needed (refer to the requirements section).

After confirming all the processes, you can proceed to the payment.

Our tax consultants will register your application. The estimated time will be around 5 working days.

Common questions

What if I do not have an NPWP ID?

Failure to pay taxes will result in criminal penalties and fines according to pph21.

How much should I pay for my individual tax?

There are some progressive tax obligations that regulate the amount of tax according to your income. You can contact our tax consultant for more information regarding your tax compliance.

Should I obtain NPWP if I am staying with a Single Entry/Business Entry Visa?

Expatriates and non-citizens of Indonesia are obligated to pay tax only if they have been staying in Indonesia for more than 183 days. This commonly applies to KITAS and KITAP holders who plan to stay permanently, work, or conduct a commercial business in Indonesia.

Requirements

To register your NPWP ID and obtain your Identification number, there are several documents you need to prepare:

- For Indonesian Individuals, scan a copy of the KTP

- For Foreign Individuals, scan a copy of a valid passport, scan a copy of KITAS (staying permit),

- Domicile Letter from Management Building or RT/RW (Subdistrict)

- Information of email and phone number

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025

From manufacturing and logistics to digital platforms and professional services, the country’s expanding economy offers immense potential for both local entrepreneurs and global investors. Thousands of business owners each year face challenges in navigating company registration, licensing requirements, and compliance obligations. The reality is that many agencies offering “company setup services” lack transparency, provide unclear […]

Lets Move Indonesia

11/28/2025

Indonesia continues to evolve into one of Southeast Asia’s most dynamic economic landscapes, with rapid digitalisation, growing industries, and an increasingly sophisticated regulatory environment. But as the system becomes more advanced, Indonesia’s tax landscape also becomes more complex. Constant updates, new reporting systems, and shifting regulations mean thousands of individuals and businesses struggle to stay […]

Lets Move Indonesia

11/28/2025