- Home

- Legal Services

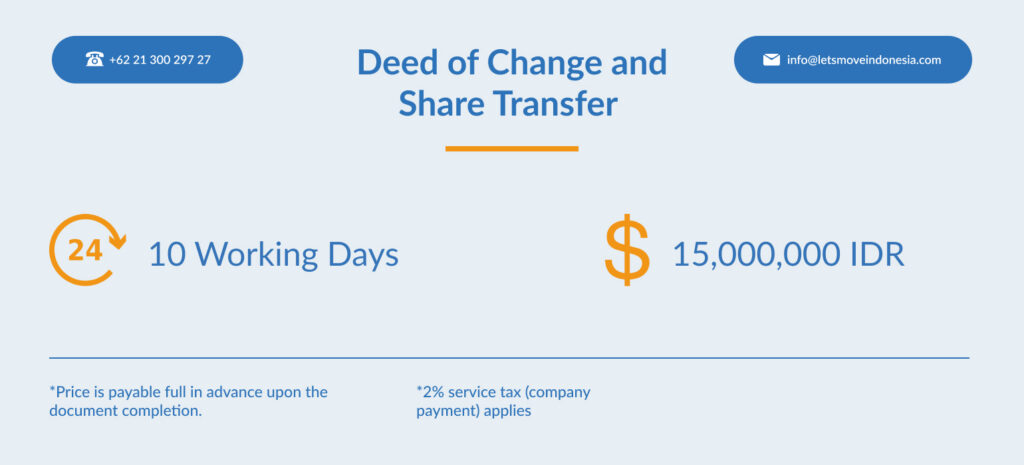

- Deed of Change

Deed of Change and Share Transfer Assistance

Company Registration & Legal Services

- Share:

In Indonesia, any modification to a company’s legal structure must be formalized through a Deed of Change or Deed of Share Transfer. These documents must be drafted by a licensed Notary and approved by the Ministry of Law and Human Rights (MOLHR).

If your corporate records are not legally updated, your company risks compliance violations, licensing delays, investment restrictions, and disputes over authority or ownership.

What Is a Deed of Change and who is it for

A Deed of Change (Akta Perubahan) is a notarial document used to update or amend a company’s legal profile. This may include changes to:

- Company name

- Registered address

- KBLI/business activities

- Directors & commissioners

- Share composition

- Articles of Association

A Deed of Change is only legally valid after receiving MOLHR approval and being updated in OSS RBA.

Who Needs a Deed of Change?

You must process a Deed of Change if your company undergoes:

1. Structural Changes

Applicable to PT, PT PMA, PT PMDN, or Representative Offices updating any legal company data.

2. Share Transfers & Ownership Changes

Any transfer of shares, partial or full must be notarized and reported to MOLHR and OSS.

3. KBLI / Business Activity Updates

Adding or removing activities, or changing business categories.

4. Management Changes

Appointments, resignations, or replacements of directors/commissioners.

5. Change of Registered Address

Especially when moving across districts or cities.

6. Licensing & Regulatory Alignment

Many industries require the company’s structure to be updated before applying for specific licenses.

Benefits of Completing a Deed of Change & Share Transfer

1. Ensures Full Legal Compliance

All amendments are officially recognized by MOLHR and government systems.

2. Protects Corporate Integrity

Reduces risks of ownership disputes, authority conflicts, and internal misunderstandings.

3. Keeps Government Records Accurate

OSS RBA, NPWP, and licensing information match your company’s actual structure.

4. Builds Trust with Stakeholders

Updated legal data increases transparency with banks, partners, investors, and regulators.

5. Supports Business Growth

New KBLIs, ownership restructuring, or management updates enable expansion and new licensing.

6. Valid Share Ownership Recognition

Your share transfer is officially documented and traceable.

7. Avoids Penalties & Licensing Issues

Ensures smooth audits, licensing applications, and corporate operations.

Share Transfer in Indonesia (for Share Below 50%)

A Share Transfer below 50% involves transferring a portion of company ownership to new or existing shareholders without changing majority control.

Even if minority shares are transferred, Indonesian regulations still require:

- Notarial Share Transfer Deed

- Shareholder approvals

- Updated shareholder registry

- MOLHR reporting

- OSS data synchronization

From drafting resolutions to finalizing government approvals, Lets Move Indonesia ensures every step is handled correctly.

Scope of Services for Changing Deeds and Share Transfer Through Lets Move Indonesia

Lets Move Indonesia provides complete, seamless, and compliant corporate amendment services, including:

1. Deed of Change

Drafting, notarial execution, and legalization for all types of company changes.

2. Share Transfer (Below 50%)

Preparation of agreements, resolutions, share registry updates, and MOLHR reporting.

3. NPWP Updates (If Needed)

Adjustments to your company’s tax records to reflect updated legal details.

4. NIB & Licensing Updates (If Required)

Changes to KBLI, business licenses, ownership, or structure via OSS RBA.

5. MOLHR Approvals

End-to-end handling of submissions and approvals.

6. OSS RBA Synchronization

Ensuring every update is reflected in Indonesia’s official licensing system.

Conditions That May Prevent a Deed of Change or Share Transfer

It cannot proceed if it:

- Exceeds foreign ownership limits under the Positive Investment List.

- Violates Articles of Association.

- Lacks necessary approvals/resolutions.

- Contains misleading or incorrect information.

- Has incomplete supporting documents.

- Involves shares under legal dispute or encumbrance.

Steps to Process Your Deed of Change with Lets Move Indonesia

- Consultation with Our Corporate Team

- Submission of Required Documents

- Invoice & Payment

- Notarial Execution & Government Approvals

- Receive Your Legal Documents

Document Requirements

General Documents

- Latest establishment deed + amendments

- MOLHR approval letters

- Company NPWP

- NIB & Business License

- Valid domicile

Management Changes

- Appointment/resignation letters

- Shareholder/board resolutions

- ID/passport of new management

KBLI or Address Changes

- New address

- Updated KBLI list

- Business operation details

Share Transfer (Below 50%)

- Share Transfer Deed

- Statement letters (transferor & transferee)

- Updated shareholder registry

- Share transfer agreement/valuation

- Identity documents

- Beneficial ownership declaration (if needed)

PT PMA Requirements

- Compliance with the Positive Investment List

- Updated investment details

Lets Move Indonesia will guide you through every document and compliance requirement.

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of Our Popular Indonesia Legal Services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025

From manufacturing and logistics to digital platforms and professional services, the country’s expanding economy offers immense potential for both local entrepreneurs and global investors. Thousands of business owners each year face challenges in navigating company registration, licensing requirements, and compliance obligations. The reality is that many agencies offering “company setup services” lack transparency, provide unclear […]

Lets Move Indonesia

11/28/2025

Indonesia continues to evolve into one of Southeast Asia’s most dynamic economic landscapes, with rapid digitalisation, growing industries, and an increasingly sophisticated regulatory environment. But as the system becomes more advanced, Indonesia’s tax landscape also becomes more complex. Constant updates, new reporting systems, and shifting regulations mean thousands of individuals and businesses struggle to stay […]

Lets Move Indonesia

11/28/2025