- Home

- Visa Services

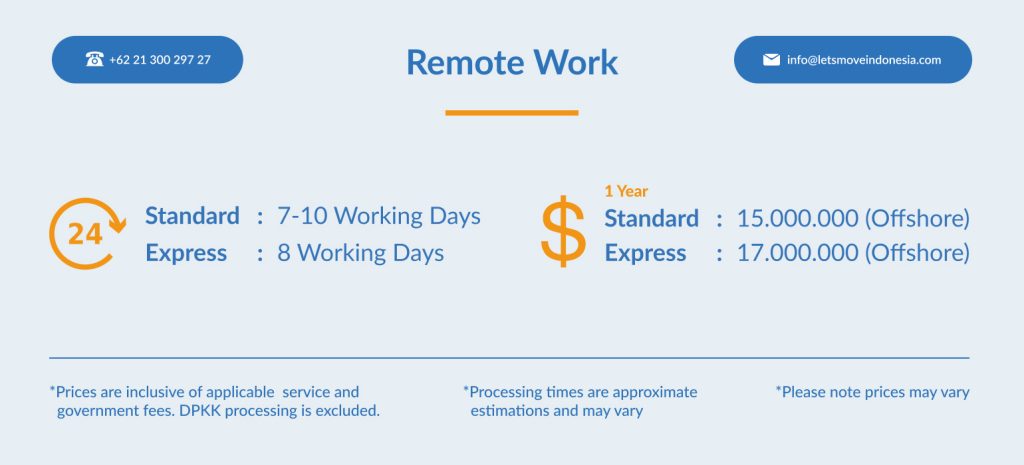

- Remote Work Visa Indonesia

Remote Work Visa Indonesia

Visa Services & Immigration Consulting

- Share:

Remote Visa (KITAS) – Who is it for and what are the benefits

As of 2024, Indonesia has introduced several more visa programmes to cater to convenient travel to Indonesia without the hassle of constant exits and re-entries or frequent immigration visits. One of them was the KITAS E33G or Remote Visa, the new entry permit aimed to aid digital nomads to embark on a journey to Indonesia.

KITAS E33G, also known as the Remote Worker VISA, a 1-year temporary residence permit that provides an opportunity to reside in Indonesia while working virtually for a company located outside the country. Designed to cater to experienced slow-living digital nomads in search of their next destination or individuals seeking to extend their stay in Bali without interrupting their employment, this visa offers an ideal solution.

Benefits of Remote Visa to Indonesia 2025

Recognising the changing nature of work and the potential benefits of attracting remote workers, Indonesia has taken a progressive step forward by launching its remote worker visa program. The Remote Worker Visa (E33G) offers a streamlined application process for those looking to make Indonesia their temporary home base. This initiative aims to make it easier for digital nomads and remote employees to live and work in Indonesia.

- Simplified Application Process: The Remote Worker Visa (E33G) provides a simplified application process, making it easier for remote workers to obtain a visa to live and work in Indonesia.

- Extended Visa Duration: The visa is valid for up to 12 months, allowing remote workers to stay and work in Indonesia for an extended period without the need for frequent visa renewals.

- Remote Work Flexibility: Remote workers can work from anywhere in Indonesia, providing flexibility and freedom to choose their preferred work location.

- Tax Benefits: Remote workers may be eligible for tax benefits and incentives provided by the Indonesian government to attract foreign professionals.

Steps to get your Remote Visa Indonesia

- Prepare and provide all the requirements. Lets Move Indonesia can help to navigate the right documents you need to provide to avoid the complexity.

- Submit all the documents to the Indonesian Immigration website

- The approval will be sent to you via e-mail

- The Remote Visa will be sent to your email and can be used to enter Indonesia.

Common Questions About Indonesia’s Remote Work Visa Indonesia

Can the remote worker visa allow digital nomads to work in Indonesia?

Yes, digital nomads can work in Indonesia, but with limitations. E33G visa holders are only authorized to work for companies registered outside of Indonesia and cannot receive income from any Indonesian entity or individual.

Can I extend my remote worker KITAS after one year?

The Remote Worker KITAS E33G is valid for a single year and cannot be renewed. To continue your stay in Indonesia, you must close your current KITAS before its expiration, leave the country, and apply for a new one.

Requirements to Obtain the Remote Worker Visa (KITAS) Indonesia

Document Requirements

Application letter (Surat Permohonan dan Jaminan)

Passport valid for at least 12 (twelve) months (for holders of travel documents other than passports such as emergency passports, documents of identity, etc. must be valid for 12 months).

Latest Color photograph with red or white background size 4X6

Personal bank statement with minimum amount USD $2000 or equivalent the last 3 months period (including name, date of period, and balance account).

Curriculum Vitae.

Travel Itinerary.

Bank account that proves income in the form of salary or income worth at least US$60,000 per year;

Employment contract with a company established outside the Indonesian Territory

Address in Indonesia

Username and Password Immigration system (Molina),

Other documents if required.

Want to know more about similar Visa options? Check out some of the other Indonesia Visas below:

- Share :

Popular Services

Interesting News

Contact Us

Speak to Our Team Now to Get Your Free Consultation!

More of our popular Indonesia Visa services

Stay informed with the latest Indonesia Visa & Business updates.

Latest News

Get to Know Latest Business & Visa Updates

For every company operating in Indonesia, understanding and properly filing annual and periodic tax returns is a core compliance obligation. Corporate tax reporting is strictly regulated by the Directorate General of Taxes (DGT), and failure to comply can lead to penalties, audits, or disruptions to business operations. This guide breaks down what corporate tax returns […]

Lets Move Indonesia

12/09/2025

Two legal permit frameworks that often cause confusion among digital entrepreneurs: PSE (Penyelenggara Sistem Elektronik) registration and the e-commerce business license, or SIUPMSE. This guide breaks down the difference between PSE and e-commerce licensing, who needs them, and why they matter. What Is a PSE License PSE stands for Penyelenggara Sistem Elektronik. It is the […]

Lets Move Indonesia

12/08/2025

If you are planning to open a business in Indonesia in 2026, it is essential to understand the latest regulatory changes issued under Peraturan Resmi BKPM No. 5 Tahun 2025. Effective 2 October 2025, this regulation reshapes how PT PMA (foreign-owned companies) are established, monitored, and managed through the OSS-RBA (Online Single Submission – Risk […]

Lets Move Indonesia

12/04/2025

Millions of Indonesians and their descendants now live overseas, forming a global community that has long sought a clear and dignified pathway to reconnect with Indonesia. For decades, returning diaspora faced complicated visa renewals, sponsorship requirements, and limited long-term options. Many families, especially those of mixed-nationality backgrounds, were left without a residency framework that recognised […]

Lets Move Indonesia

11/28/2025

From manufacturing and logistics to digital platforms and professional services, the country’s expanding economy offers immense potential for both local entrepreneurs and global investors. Thousands of business owners each year face challenges in navigating company registration, licensing requirements, and compliance obligations. The reality is that many agencies offering “company setup services” lack transparency, provide unclear […]

Lets Move Indonesia

11/28/2025

Indonesia continues to evolve into one of Southeast Asia’s most dynamic economic landscapes, with rapid digitalisation, growing industries, and an increasingly sophisticated regulatory environment. But as the system becomes more advanced, Indonesia’s tax landscape also becomes more complex. Constant updates, new reporting systems, and shifting regulations mean thousands of individuals and businesses struggle to stay […]

Lets Move Indonesia

11/28/2025