Indonesia, with its natural beauty, cultural richness, and dynamic economy, has captivated the hearts of countless expatriates. By demystifying the complexities of the Indonesian property market and equipping expats with the knowledge needed to navigate the mortgage landscape, we aim to empower individuals to make informed decisions about their future.

In this article, we embark on an exploration of the possibilities of an expat mortgage in Indonesia, unlocking the doors to homeownership for those seeking to build their lives in this enchanting nation.

Introduction

With a rapidly growing economy and a diverse population, the country has witnessed a notable influx of foreigners calling it home. As a result, the demand for expat mortgages in Indonesia has gained significant traction, enabling expatriates to invest in real estate and establish a sense of stability in their adopted country.

According to the World Bank, Indonesia’s economy has grown rapidly over the last decade, with an average annual GDP growth rate of around 5%. This upward trend, combined with a favourable investment environment, has attracted a slew of foreign professionals and entrepreneurs eager to capitalise on Indonesia’s potential.

As expats settle in, the desire to own property and build a foundation grows, necessitating the need for accessible mortgage options tailored to their specific circumstances.

Is it possible for expats to get a mortgage in Indonesia?

Not only Indonesian citizens (WNI) but also foreign citizens (WNA) can now enjoy the property mortgage facility. As is known, the government has enacted regulations regarding permits for foreigners to buy property in Indonesia. Article 186 of Agrarian and Spatial Planning/National Land Agency Regulation Number 18/2021 regulates the limitation of home ownership for foreigners:

For the site house:

Houses with the category of luxury houses in accordance with the provisions of laws and regulations; 1 piece of land per person/family; and/or the land is at most 2,000 m2;

For flats:

Flats in the category of commercial flats. In the case of providing a positive impact on the economy and society, the site house can be given more than 1 piece of land or an area of more than 2,000 m2, with the permission of the minister in charge of government affairs in the fields of agriculture, land, and spatial planning.

It is stated in the article that foreigners are allowed to have landed houses with status built on state land or private land with the Right to Use (HPL) Certificate. In addition, foreigners are also allowed to own flats or apartments that stand on land with the status of building use rights (HGB). Referring to these regulations, it is certain that not all types of property can be purchased by foreigners, even with ownership rights.

Foreigners are not allowed to own property with a Certificate of Ownership (SHM). In accordance with applicable regulations, property with certificates of ownership may only be owned by Indonesian citizens. Even so, as mentioned above, foreigners can still apply for a property purchase using a mortgage.

However, there are a number of terms and conditions that must be met when applying for a mortgage for foreigners. In addition, the choice of banks providing mortgage facilities for foreigners is limited. Not all banking institutions in Indonesia serve mortgages for foreigners.

What are the requirements to apply for a mortgage in Indonesia?

In order to apply for a mortgage in Indonesia, here are the requirements that all expats must meet:

- All nationalities except African territories citizens

- For employees : min. 2-year working periods (including previous working periods)

- For self-employed: min. 4 years within the industry

- 21-57 years old

- Minimum income IDR 25 million/month

- Maximum credit period is 25-30 years

Documents needed:

- KITAS/KITAP/KIMS/KTP WNA

- NPWP ; annual tax return

- Marriage Certificate, Birth Certificate, Prenup Agreement

- Reference Letter, Company legality

- Saving Account mutation

- Collateral document

If the applicant is self-employed, there are some additional requirements that the applicant must submit like notary company act (Akta PT), domicile licence (SKTU) if any, trade licence (SIUP/NIB), etc.

How much is the minimum purchase for expats to get a mortgage in Indonesia?

Agrarian and Spatial Planning/National Land Agency Regulation Number 1241/2022, sets the minimum price limit as follows:

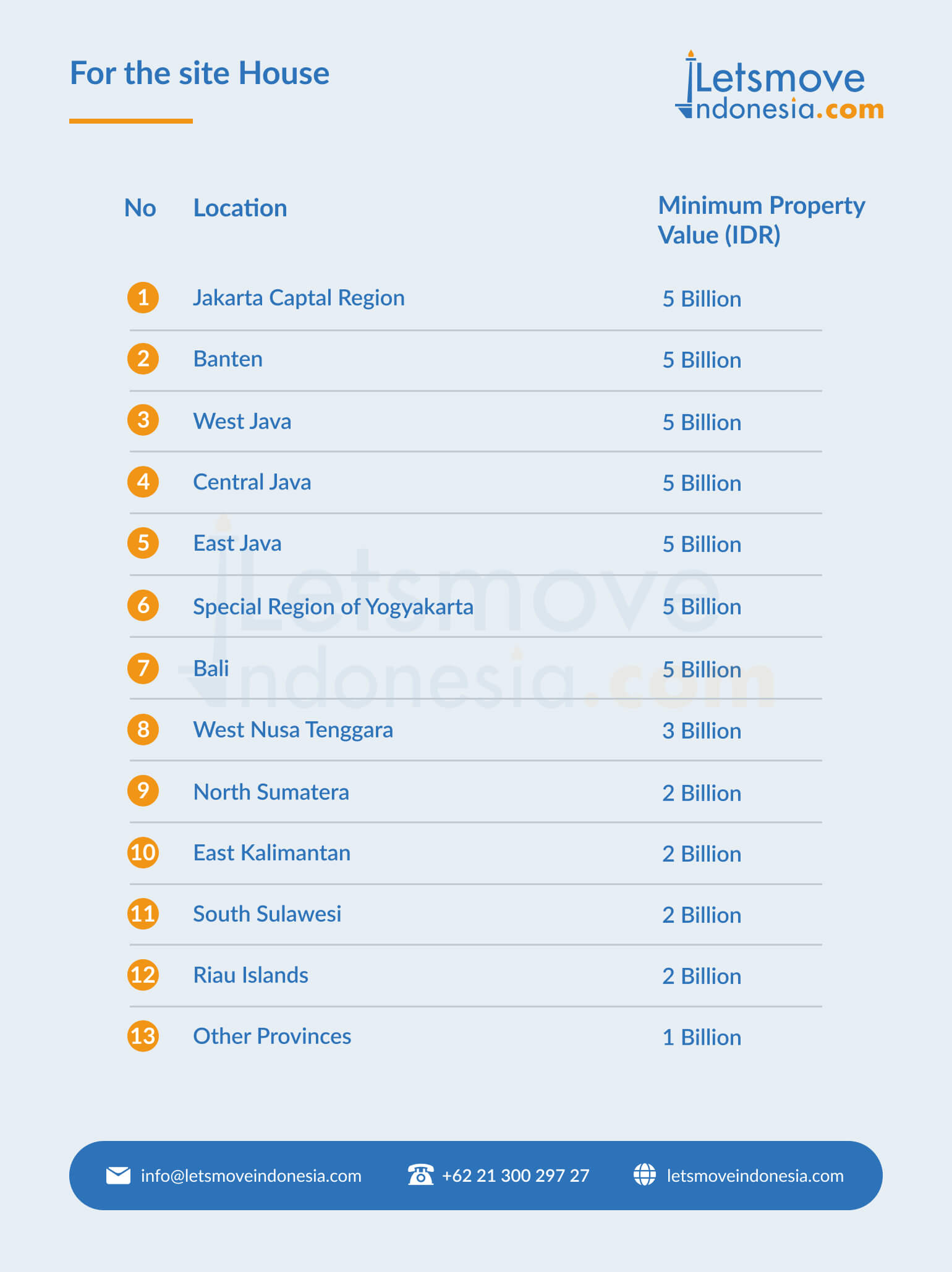

For the site house:

For the apartment:

Benefits and challenges of an expat mortgage in Indonesia

Expat mortgages in Indonesia offer several benefits, including the opportunity to invest in the property market, build equity, and enjoy stability in the long run.

However, there are also challenges to consider, such as language barriers, unfamiliarity with local processes, and potential differences in mortgage terms and requirements compared to one’s home country.

It is crucial for expatriates to conduct thorough research and seek professional guidance to navigate these challenges successfully.

Found this article interesting? Then check out our other useful articles about visas here!

Exploring Possibilities of The Expat Mortgage in Indonesia

Your Path to Property Ownership: Essential Steps for Obtaining Mortgage in Indonesia

Decoding Indonesian Mortgage Products: The Essential Guide for Homebuyers

Top Banks that Partnered with LetsMoveIndonesia for Mortgage

Get Your Desired Mortgage with LetsMoveIndonesia: What You Need to Know